Picture this: You've just completed a fantastic project for a client, and the finish line is in sight. You're ready to bask in the glory of a job well done and eagerly await that long-anticipated paycheck. But wait, there's one more important step before you can start counting the cash – invoice processing.

In this article, we'll show you how to demystify invoice processing, equip you with the knowledge and tools to streamline your invoicing workflow, and ensure you get paid for your hard-earned work in a timely and professional manner.

What Is Invoice Processing?

As a freelancer, you're no stranger to the thrill of completing projects, but the satisfaction of a job well done isn't truly complete until you get paid for your hard work. That's where invoice processing comes into play.

Definition of invoice processing

Invoice processing is the vital bridge between you and your hard-earned money. It's the systematic way in which you create, submit, track, and get paid for the services you provide as a freelancer. Without it, you'd be left in the dark, wondering when and how you'll receive your well-deserved compensation.

Importance of invoice processing for freelancers

As freelancers, we often wear multiple hats, and handling invoices may not be our favorite task. However, understanding and mastering invoice processing is crucial for several reasons. It ensures you get paid promptly, maintains a professional image, helps with financial record-keeping, and can even save you from tax-time headaches.

Preparing Your Invoices

Now that you're well-acquainted with the importance of invoice processing, let's dive into the nitty-gritty of getting started.

Creating professional invoices

Your invoice is essentially your payment request, and first impressions matter. A professionally crafted invoice should include your contact information, the client's details, a clear description of the services provided, the total amount due, and your payment details.

Required information in invoices

Be meticulous about including essential information such as the invoice date, due date, and an invoice number. This helps you and your client track payments and ensures no confusion down the road.

Invoice numbering and tracking

Assigning unique invoice numbers is a great way to keep things organized. You can use a simple numbering system or invest in invoicing software that automates this process. Just make sure your numbering is sequential, and you're good to go.

Here's how to effectively use invoice numbers and tracking for seamless management:

Tip 1: Assign sequential invoice numbers

Start with an initial number and increment it with each new invoice you create. This sequence helps you maintain order and makes it simpler to search for specific invoices.

Tip 2: Consistency is key

Keep the format and structure of your invoice numbers consistent. For example, you might use "INV-001," "INV-002," and so on. This consistency ensures your invoices are easy to manage and sort.

Tip 3: Maintain a record

Create a record or spreadsheet that includes each invoice's number, client name, due date, and payment status. This record will be invaluable for tracking and following up on payments.

By creating professional invoices and paying attention to the required details, you set the stage for smooth and efficient invoice processing. Remember, a well-crafted invoice not only helps you get paid promptly but also reflects positively on your freelancing business.

Creating an Invoice: Various Methods for Freelancers

As a freelancer, creating professional invoices is a critical part of your business operations. The good news is that you have several options when it comes to crafting and sending invoices. Let's explore these methods to find the one that works best for you.

Pen and paper

The most basic method is to draft your invoices using pen and paper. You can create a template that includes all the necessary details and fill it out for each client. While it's low-tech, it can work well for freelancers with a small client base.

Pros:

- Low Cost: No need to invest in software or tools.

- Simplicity: Basic and easy to use, suitable for small-scale freelancers.

Cons:

- Manual Work: It's very time-consuming and prone to errors.

- Limited Features: It also lacks automation and tracking capabilities.

Spreadsheet software

Tools like Microsoft Excel or Google Sheets allow you to design customized invoice templates. You can save these templates and reuse them for different clients.

Pros:

- Customization: You can create personalized invoice templates.

- Ease of Use: Familiar interface for many users.

- Cost-Effective: Most freelancers already have access to spreadsheet software.

Cons:

- Limited Automation: It can be time-consuming, requiring a lot of manual work.

- No Payment Tracking: Limited features for tracking payments and reminders.

Word processing software

Word processing software like Microsoft Word or Google Docs can also be used to create invoice templates. While less spreadsheet-like, they provide a more flexible design for your invoices.

Pros:

- Design Flexibility: Allows for more creative and visually appealing invoices.

- Easy Editing: You can easily modify and update templates.

Cons:

- Semi-Automation: Lacks advanced automation features.

- Not Built for Invoicing: May require more effort to set up invoice templates.

Dedicated invoicing software

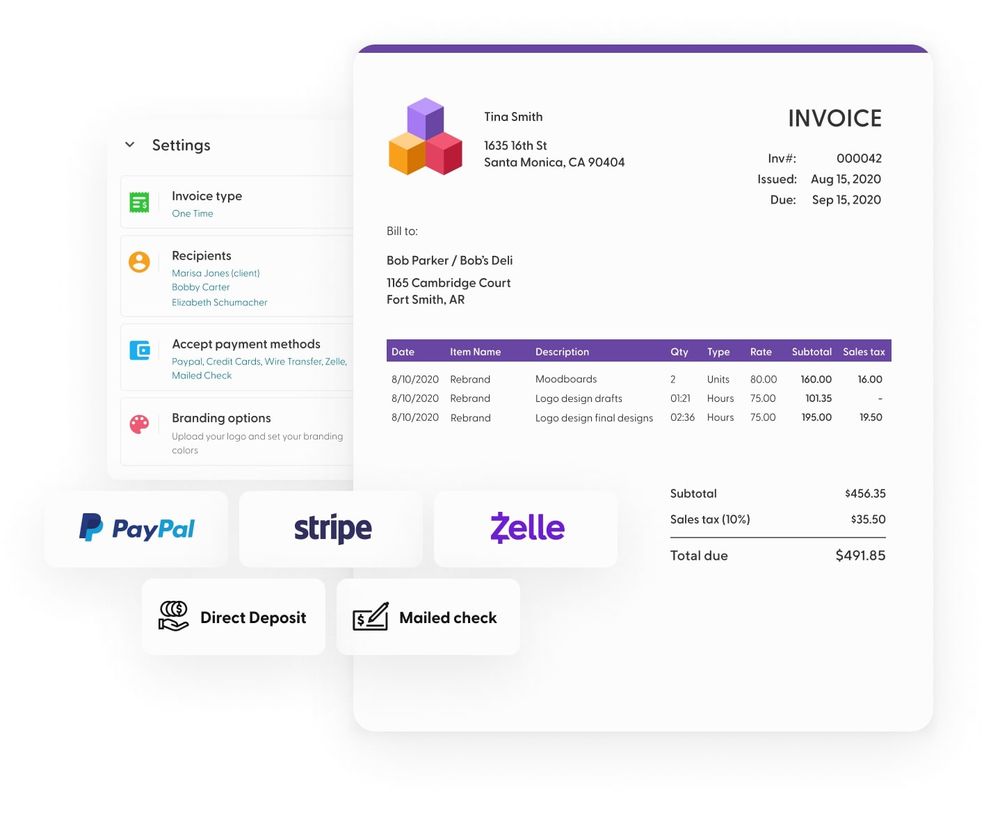

The fastest method for billing clients is to use an invoice processing software, like Indy, which offers a wide range of features, including the ability to create professional invoices, track payments, send automatic reminders, create recurring invoices, and get paid all in one place.

Not only does it keep your invoice data secure, but it also saves you hours of work by eliminating manual data entry, making it easier to manage payments.

Pros:

- Automation: Streamlines the entire invoicing process, from creation to tracking and reminders. Automated invoice processing also safeguards against the accidental sending of duplicate payments by automating the invoice numbering process.

- Professional Templates: Offers pre-designed, professional-looking templates.

- Payment Integration: Often includes payment gateways, making it easy for clients to pay online.

- Expense Tracking: May include expense tracking and reporting features.

Cons:

- Cost: Typically involves a subscription or one-time purchase cost. Although, some invoicing platforms, like Indy, have a free plan.

If you're looking for the quickest way to send invoices, you can get started with Indy for free! Using a dedicated invoice processing system takes the stress away from invoicing.

Submitting Invoices to Clients

With your invoice in hand, it's time to send it to your client.

Choosing the right delivery method

The method of delivery can depend on your client's preferences. You might send invoices via email, through an online invoicing platform, or even by traditional mail. Ensure you confirm the preferred method in advance.

Setting payment terms and due dates

Payment terms are essential. They specify when and how you expect to be paid. Common terms include "Net 14" (payment due 14 days after the invoice date) or "Upon receipt" (payment due immediately). Clear due dates prevent delays and misunderstandings.

Following up on unpaid invoices

Sometimes, despite your best efforts, invoices go unpaid. Don't panic; it happens to the best of us. Set up a polite but firm follow-up process that includes reminders and, if necessary, late fees. Effective communication is key.

Receiving and Reviewing Invoices

Now, let's switch gears and talk about the other side of the coin: when you're on the receiving end.

How clients handle invoices

Your clients have their own invoice processing procedures. They may use different formats, from PDFs to Word documents to online invoicing systems. Be adaptable, and familiarize yourself with their preferred method.

Common invoice formats

Understanding these formats is essential for a smooth process. If you're dealing with various clients, it's wise to have the necessary software or apps to open and edit different file types.

Checking for accuracy and completeness

When you receive an invoice, don't just skim it. Review it carefully to ensure the charges and details align with the work you've received. This step can save you from overpaying or dealing with billing disputes later.

Approving Invoices

Now that your client has received the invoice, it's time to approve it.

The approval process

Your client may have an internal process for approving invoices. This could involve multiple levels of review and authorization. Be patient, but gently follow up to expedite the process if it takes too long.

Handling client feedback or revisions

Occasionally, your client may have feedback or requested changes to your invoice. Don't take it personally; it's a part of the game. Make the necessary adjustments promptly and resubmit the revised invoice.

Resolving discrepancies

In rare cases, there may be discrepancies or disputes regarding the invoice. Always address these issues professionally, provide documentation, and work toward a friendly resolution. Effective communication can save relationships and protect your income.

Making Payments

Finally, the moment you've been waiting for – getting paid!

Payment methods and preferences

Clients have various ways to pay you, from direct bank transfers and checks to online payment platforms like PayPal. Make sure you and your client are on the same page regarding the preferred payment method.

Tracking payments received

Once the payment is made, confirm its receipt. Keep a record of all payments and cross-reference them with your invoices. This tracking ensures you get paid what you're owed.

Handling international payments

If you work with clients from around the world, consider the complexities of international payments, such as currency exchange rates and transaction fees. Explore payment platforms that simplify cross-border transactions.

Managing Invoices and Records

The paperwork doesn't end once you've received your payment. Proper record-keeping is essential for a freelancer's financial health.

Organizing and storing invoices

Create a system for organizing and storing your invoices. Whether you use a digital solution or physical files, keep everything neatly categorized and easily accessible.

Backup and security measures

Protect your financial data by having backup systems in place. Invest in secure cloud storage and maintain backups of your financial records.

Tax and legal considerations

Understand the tax implications of your income as a freelancer. Consult with a tax professional to ensure you're meeting your legal obligations and keeping your financial house in order.

Automating Invoice Processing

As your freelancing career grows, you might want to streamline the process.

Benefits of automation for freelancers

Automating invoice processing can save you time and reduce human errors. It ensures consistency and helps you stay on top of your invoicing game.

Tools and software for invoice automation

There are numerous tools and software solutions designed to automate the invoice processing workflow. Explore options that fit your needs and budget.

Best practices for implementing automation

When implementing automation, start with small steps and gradually transition to a more automated process. Ensure you're still maintaining personal touches in your client interactions.

7 Ways to Set Up Invoice Processing Automation

If you want to save time on invoicing, here are 7 powerful ways you can set up invoice processing automation and make billing even easier.

1. Recurring invoices

Automation allows you to schedule and send recurring invoices for retainer clients or subscriptions. You can set the frequency, start date, and end date, and the system will generate and send invoices automatically.

Benefits: Recurring invoices save time and help maintain a steady cash flow, especially for services that are billed at regular intervals. It minimizes the risk of forgetting to bill clients for ongoing work.

2. Payment reminders

Automated reminders can be set up to send polite payment reminders to clients as the due date approaches. This reduces the need for manual follow-ups and improves cash flow.

Benefits: Payment reminders reduce the need for manual follow-ups and help maintain a positive client-freelancer relationship. They are effective in improving cash flow by encouraging on-time payments.

3. Late payment notifications

If a client misses the due date, automated late payment notifications can be triggered. These reminders can include information about late fees or penalties.

Benefits: Late payment notifications can help deter clients from delaying payment and protect your income. They ensure that clients are aware of the consequences of late payments, such as added costs.

4. Payment confirmations

Once a payment is received, an automated payment confirmation can be sent to the client, acknowledging the receipt of funds and providing a receipt.

Benefits: Payment confirmations enhance professionalism and transparency. Clients appreciate receiving a prompt acknowledgment of their payment, which can build trust and streamline the payment process.

5. Time tracking

If your freelance work involves hourly billing, time-tracking automation can log your hours and convert them into billable time entries on your invoices.

Benefits: Time tracking automation reduces the manual effort required for hourly billing. It provides accuracy and transparency in your invoicing, ensuring clients have a clear breakdown of the work performed.

6. Archiving and storage

Invoices can be automatically archived and stored securely in the cloud. This ensures that you have a record of all past invoices without the need for manual filing or storage.

Benefits: Automation in archiving and storage minimizes the risk of losing or misplacing invoices. It simplifies record-keeping and is particularly valuable for auditing and tax purposes.

7. Reporting and analytics

Automation can provide you with financial reports and analytics. You can generate insights into your income, expenses, and overall financial health.

Benefits: Reporting and analytics automation offers a deeper understanding of your financial status. It aids in making informed decisions, tracking financial goals, and assessing the profitability of your freelancing business.

Tips for Efficient Invoice Processing

While you might not become an invoice processing expert overnight, you can certainly optimize your workflow.

Time management and prioritization

Set aside specific times for invoicing tasks to avoid procrastination. Prioritize it like any other project, and don't let invoices pile up.

Communication with clients

Open and clear communication with your clients is key. If you have questions or concerns about an invoice, don't hesitate to reach out to your client for clarification.

Avoiding common invoice processing mistakes

Learn from the mistakes of others. Be vigilant about common pitfalls like missing details, incorrect calculations, or late submissions.

A Quick Recap

Invoice processing is the engine that keeps your freelancing business running smoothly, but as a freelancer, you don't have the benefit of having your very own accounts payable department like larger businesses do. That's where invoice processing software comes in!

Remember the essential components of invoice processing: creating professional invoices, setting clear payment terms, tracking payments, and maintaining a robust record-keeping system. By mastering it, you'll not only get paid faster but also build a reputation for professionalism that can attract more clients. So, keep those invoices flowing, and watch your freelancing career soar!

Indy has everything you need to send invoices quickly, including templates, flexible billing methods, payment gateways, client portals, automated workflows, and more. And the best part? You can get started now for free! Ditch the paper invoices. Get everything set up and send a professional invoice in just minutes.