PayPal is mandated to send out form 1099-K to freelancers and independent contractors that receive their payments through their platforms. This form makes it easy to keep track of their payments transactions which makes calculating their income for the year and their tax obligation less hectic.

If you receive most of your payments through PayPal, it is crucial to know how to treat the 1099-K form you will get every year and how to use it when paying taxes for the applicable tax year.

This article provides a comprehensive guide for filing PayPal 1099-K taxes, starting with what these forms are all about and who should receive them.

What is Form 1099-K?

Form 1099-K is a special-purpose tax form that reports the payments you get via third-party network transactions and for both debit and credit card transactions.

Essentially, these forms record transactions made through a payment settlement entity like PayPal. If you use credit and debit card processing services, the total from your transactions should be recorded in a 1099-K and sent to the taxpayers to help calculate taxable income.

Independent contractors and other self-employed individuals have to report business income from form 1099-K on Schedule C when filling out form 1040 for their annual income tax.

Who Receives Form 1099-K?

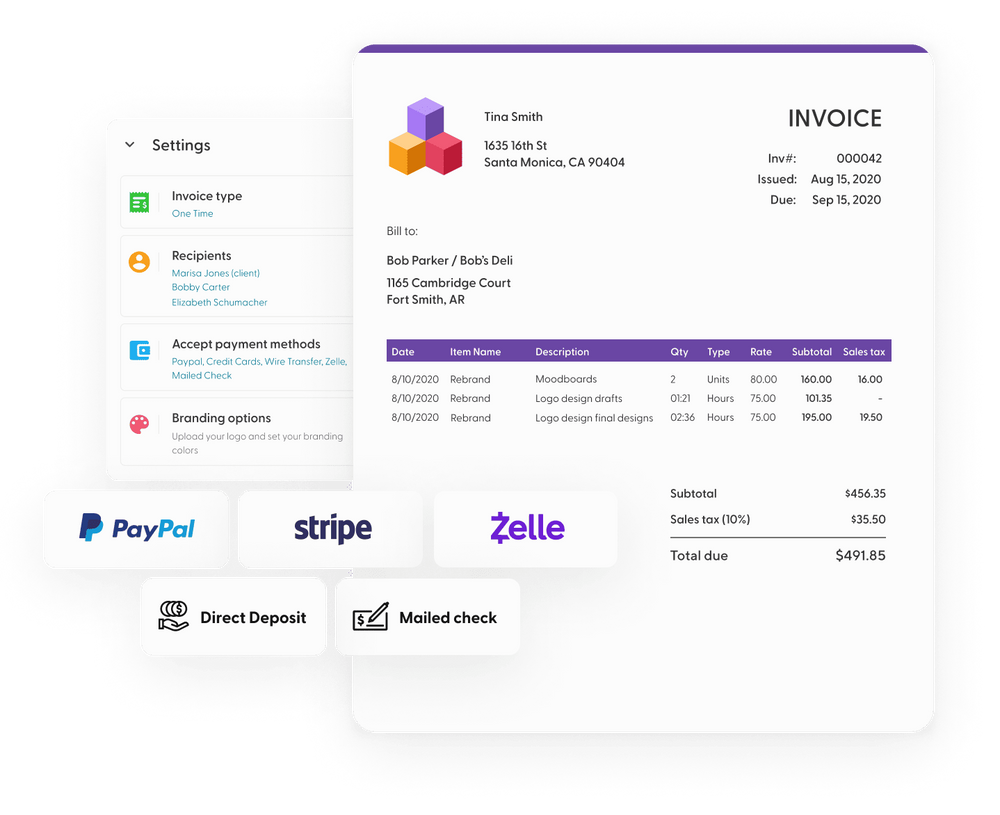

Anyone that receives payment in settlement of third-party network transactions like PayPal, Venmo, and Zelle or receives compensation through debit cards, credit cards, and stored value cards within a calendar year should receive a 1099-K form.

However, there are still a few other conditions determining who will receive these forms.

1. For the tax year 2023 and all others before it, you have to receive over $20,000 through a third party network transaction or get debit/credit card payments of the same amount within the tax year

2. For the tax year 2023, you also have to make at least 200 transactions within the year. Therefore even if you get more than $20,000 worth of payments in under 200 transactions, you will not get the form.

3. For the tax year 2024 and all others that will follow, you will receive form 1099-K provided your gross payment from a debit/credit card or third-party payment settlement entities is at least $5,000. Additionally, there will be no transaction threshold, meaning you still get the form even if the payments are from one or a couple of transactions.

How to Read Form 1099-K

It is vital to ensure that the income your report on your tax return correlates with what is included in your 1099-K.

Remember that the IRS will also get a copy of the form. If your business income does not match what they have on their records, you might be flagged for a tax audit because of underreporting your earnings. You are better off paying more taxes than what you owe and asking for a tax refund later than underpaying.

Reading the 1099-K form to check whether it is accurate is relatively straightforward. You only need to check your payment card receipts records and other things like payment card transactions and ensure they tally with what is reported on Form 1099-K.

Make sure you have reported income from all your forms of payment and not just PayPal. Check other things like debit/credit cards and ensure accurate gross receipts records. Having backup PayPal and payment card receipt records for all your payment transactions will also be very useful as you can compare this with what you have on the 1099-K.

Besides making sure the gross payments are correct, it is also vital to check the tax identification number (TIN) and merchant code to make sure they are right. Also, make sure the forms you have belong to you by checking your name and telephone number as sometimes they can get mixed up. Your telephone number and name will be on the lower-left corner of the tax form.

Other Tax Forms You Receive As a Freelancer That Uses Paypal

IRS Form 1099-K is one of the primary forms you will need to prepare your income and self-employment tax return if you receive payments through PayPal, but it is not the only one. You should also expect to get the 1099-NEC form from your clients for reportable payment transactions of $600 or more.

The 1099-NEC replaced the 1099-MISC from the 2020 tax year as the main IRS tax form for reporting non-miscellaneous income and non-employee compensation for freelancers, independent contractors, and other workers that are not on a company's payroll.

If you do not meet the conditions for receiving the 1099-K tax forms, the chances are you will get the 1099-NEC provided your PayPal payments or total payment card transactions for the year are over $600. Most freelancers and other 1099 employees get several of these every year, and they are vital for tax preparation as they make it easy to keep track of your self-employment income.

It is also important to note that different states have varying requirements. Therefore, the specific 1099 forms you get or need to file your tax returns will depend on where you earn your income and pay taxes. Some states like Vermont and Massachusetts will require you to file 1099-K instead of 1099-NEC if your business income from your non-employee endeavors is more than $600.

What Tax Deductions Do You Qualify For?

Another vital factor to understand when dealing with PayPal 1099-K taxes is the tax deductions you are entitled to as a self-employed individual. Deducting these tax deductibles from your gross payments helps reduce your total business income to ensure you pay less income tax.

Here are a few of these tax deductions you should take advantage of when getting paid through PayPal:

1. PayPal fees

As a freelancer or independent contractor that gets paid through a payment settlement entity like PayPal, you should be ready to incur costs for receiving the cash. PayPal has several fee types, and you can expect to pay anything from $1 to $10,000, depending on the transaction type and amount.

Since these fees are an expense for your business, they are tax-deductible. from your total income. The fees you pay will be shown as "Other Expenses" under the "Business Expenses" section of your Schedule C.

2. Home office deductions

The Internal Revenue Service allows freelancers to deduct office costs from their taxable income if they use part of their home for their freelance business.

You can use the IRS's simple method to calculate the deduction amount. Here you should measure the size of your home office and multiply this by the $5 per square foot IRS rate. Therefore, if your home office is 200 square feet, you can deduct up to $1,000 (200 square feet x $5).

3. Health insurance premiums

You can deduct the premiums from your taxable income if you contribute to a health plan for yourself, your spouse, and your dependents. Qualifying freelancers can deduct up to 100% of what they pay in health insurance premiums. The premiums include dental care and even long-term care health insurance payments.

4. Business meal deductions

You can also make business meal deductions when filing your income tax return. These deductions are for all the meals and entertainment costs you will incur when meeting clients and doing other business-related activities to help your freelance venture grow and generate more income.

5. Phone and internet bill

Freelancers work remotely and will often have to make several calls to the clients and other individuals vital for the execution of their business. Also, they need to use the internet every day. Both are relevant business expenses that you can use to lower your income tax during tax preparation.

Note: You can make several other tax deductions to lower your taxes. However, it is vital to make sure the IRS allows them and that you have some proof they are a direct business expense. Getting some tax advice from a tax professional can be highly useful when figuring out all your tax deductions.

How to Use 1099-K Form to Prepare Taxes

Form 1099-K will make it easy to determine your gross payments for the year. While this is highly useful for tax preparation, you still need to understand how to treat these forms when filing your tax returns.

You will need to keep all your form 1099-Ks and not just what you get from Paypal, as each represents a part of your gross payments for the year. You should use information from these payment transactions to report your quarterly and annual income on Schedule C.

As you record your form 1099-K reportable payment, make sure you do not forget other earnings. They include a direct deposit to your bank account, cash payments, cash equivalents, receipts from another third-party payment network, refunded amounts, and discounts, as they should all be part of your annual income.

Also, make sure to add the Paypal fees if the client paid for them when sending you the payment. But, don't worry, this will not be an additional fee for you since it is tax-deductible, meaning you can include it in the tax deductions to lower your taxable income.

Differentiating Personal and Business Income on PayPal

If you use your PayPal account for both personal and business payments, you might have some challenges when it comes to tax time, as the form 1099-K you get will include everything.

Some personal incomes, such as getting a gift from family or friends, might not be taxable, so you will need to treat this payment differently from what clients pay you, hence the need for differentiation.

An easy way to avoid the hassle of sorting out dozens of transactions to determine what is personal and what is for business is to have a different payment settlement entity account for your business. PayPal allows you to have separate business and personal accounts.

New Form 1099-K Regulations

There have been some changes in form 1099-K regulation in the 2024 tax year and the tax years that will follow. The Biden administration will now require a payment settlement entity like Paypal to issue a 1099-K form to all users that receive $5,000 or more and not $20,000 as it has been for previous tax years.

Also, there will be no minimum reporting thresholds for the number of transactions. Therefore, even if you get one Paypal payment, you will get a form 1099-K provided it is worth $5,000 or more.

The new regulation aims to deal with 1099 employees that have been taking advantage of the higher $20,000 reportable payment requirement for PayPal and other third-party settlement organizations to avoid taxes.

Final Remarks

The form 1099-K makes filing tax returns easy as you can quickly tell how much money you made in the year. However, you still need to keep backup records to ensure you file an accurate income tax return, as some of these forms can sometimes have errors.

Additionally, also keep track of all your other payments and income sources as you have to report everything and take advantage of your tax deductions to reduce your tax burden.

And in case you still have some difficulties filing PayPal taxes, make sure you get tax advice from tax professionals, so you do not land into trouble with the Internal Revenue Service.