Imagine this nightmare: You've just finished a brilliant year of freelancing and you're about to spend some of your earnings on a vacation or a new gadget for yourself. But then you get a letter from the IRS. They've audited your tax return and found some errors. Now you have to pay thousands of dollars in back taxes, penalties, and interest. The IRS crushed your dreams and you're left with a huge tax bill.

This is a terrible feeling that many freelancers and independent contractors face every year. Taxes can be complicated, confusing, and irritating for self-employed workers. It's also super easy to make freelance tax mistakes that can cost you big time. But it doesn't have to be this way. In this article, we'll show you 10 tax tips that can help you avoid the most common freelance tax mistakes and file your taxes correctly and efficiently. Whether you're new to freelancing or a seasoned pro, these tips will help you save money, avoid trouble, and stay on top of your freelance finances.

Neglecting to calculate your estimated taxes

Your quarterly estimated taxes due will be based on your prior year’s earnings. The IRS has issued a handy guide on completing the 1040 ES form. You may need to make quarterly estimated tax payments to avoid penalties and interest.

Many freelancers and independent contractors don't realize that they have to pay taxes throughout the year, not just at the end of the year. They may also find it difficult to estimate how much they owe in quarterly taxes, especially if their income fluctuates from month to month.

The best way to avoid this mistake is to plan ahead and set aside a percentage of your income for taxes every time you get paid. You can use the 1040 ES form or an online calculator to estimate how much you need to pay each quarter. Or, even better, just set aside 40% of your net profits for taxes. If this starts to look like too much, adjust it a little. But it feels way better to have too much in the bank than it does to be faced with a huge bill and have nothing in the bank.

Failing to declare your independent contractor status

If you agree to a full time job or do some work for a client, make sure you have a written contract that specifies your role as an independent contractor. This can help you avoid misclassification issues with the IRS or the Department of Labor.

Some freelancers and independent contractors don't bother to sign a contract with their clients or they accept vague or ambiguous terms. This can lead to confusion and disputes over whether they are employees or contractors, which can affect their tax obligations and rights.

The best way to avoid this mistake is to have a clear and detailed contract with every client you work for. The contract should outline the scope of work, the payment terms, the deadlines, and the expectations of both parties. It should also state that you are an independent contractor and not an employee of the client. You should also keep records of all your business expenses, invoices, receipts, and communications with your clients to prove your independent contractor status in case of an audit or a lawsuit.

A great way to organize your contracts is to use Indy’s Contracts tool. You can quickly write a contract, add an e-signature block, and send it to a potential client. Once everyone has signed, your contract will be safely stored for future reference.

Missing out on deductions

As an independent contractor, you can deduct many business expenses from your income, such as home office, travel, supplies, equipment, software, etc. Keep track of your receipts and use Schedule C to report your income and expenses.

Some freelancers and independent contractors don't know what expenses they can deduct or they forget to keep records of them. They may also be afraid of claiming too many deductions and triggering an audit.

You can escape this trap by educating yourself on the tax rules and regulations for self-employed workers. You can use the IRS website, a tax guide, or a professional tax preparer to learn what expenses are deductible and how to document them. Keep a separate bank account and credit card for your personal expenses and business transactions. Use an app or other software to track your income and expenses throughout the year. Try to always be reasonable and honest when claiming deductions. Don't exaggerate or lie about them.

Misusing payroll deposit funds

If you have employees or subcontractors working for you, you need to withhold and remit payroll taxes to the IRS on their behalf. Don't use these funds for other purposes or you may face severe penalties.

Some freelancers and independent contractors may be tempted to use the payroll deposit funds as a source of cash flow for their business or personal needs. They may also forget to pay the payroll taxes on time or at all.

The best way to avoid this mistake is to treat the payroll deposit funds as sacred and untouchable. This means you should set up a separate bank account for these funds and transfer them to the IRS as soon as possible. An easy way to do this is to use a payroll service or different accounting software, to calculate and pay the payroll taxes accurately and timely. You should also file the required forms and reports with the IRS and the state agencies to avoid any penalties or audits.

Filing late tax returns

As an independent business owner or contractor, you need to file your tax return by April 15th (or October 15th if you request an extension). Filing late can result in late-filing penalties and interest charges.

Some people are tempted to procrastinate or neglect to file their tax returns on time. They may also be overwhelmed by the complexity of their tax situation or lack the necessary information or documents to file their returns.

Don't fall into this trap. Instead, file your tax return as early as possible. You can use a tax software or a professional tax preparer to help you file your return correctly and efficiently. Gather and organize all your income and expense records before you start filing your return. If you need more time, you can request an extension by filing Form 4868, but remember that this only extends the time to file, not the tax time to pay.

Not reporting all your income

You need to report all your income from your freelance or independent contract work, even if you don't receive a 1099-NEC form from your client. Income, even if it’s paid in cash, generally has to be reported unless the law specifically exempts it.

Some freelancers and independent contractors may think that they don't have to report their income if they don't receive a 1099-NEC form or if they receive less than $600 from a client. They may also assume that the IRS won't know about their income if it's paid in cash or through an online platform.

The best way to avoid this mistake is to report all your income from your freelance or independent contract work, regardless of the amount or the form of payment. You should keep track of all your invoices, payments, and receipts throughout the year. You should also remember that the IRS may receive information about your income from other sources, such as banks, payment processors, or online platforms. If you fail to report your income, you may face penalties, interest, or audits from the IRS.

Not paying self-employment tax

As an independent contractor, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This is called self-employment tax and it's calculated on Schedule SE. The self-employment tax rate is 15.3% of your net earnings from self-employment.

It's possible some people may not be aware that they have to pay self-employment tax in addition to income tax. They may also think that they can avoid paying self-employment tax by forming an LLC or an S-corporation.

The best way to avoid this mistake is to understand the rules and regulations for self-employment tax. Check out the IRS website, a tax guide, or a professional tax preparer to learn how to calculate and pay your self-employment tax. Forming an LLC or an S-corporation may not exempt you from paying self-employment tax, depending on your situation and how you pay estimated taxes on yourself. You should consult a tax professional before making any changes to your business structure.

Not keeping accurate records

You need to keep accurate records of your income and expenses throughout the calendar year. This can help you prepare your tax return, claim deductions, and avoid audits.

It's possible you may not have a system or a habit of keeping records of their business transactions. Disorganized people may also lose or misplace their receipts, invoices, or their business bank account statements.

It's super important for you to keep and organize all your records of your business income and expenses. Use a separate bank account and credit card for your business transactions and use an app or other software to track your finances. You should also scan or store your receipts, invoices, and bank statements in a safe place. Keep your records for at least three years after you file your tax return or longer if you have special circumstances.

Not saving for taxes

As an independent contractor, you don't have taxes withheld from your paychecks like employees do. That means you need to save enough money to pay your taxes when they are due.

New or inexperienced freelancers and independent contractors may not budget or plan for their taxes. They may also spend their income on other things and not have enough money to pay their taxes when they are due.

The best way to avoid this mistake is to save for your taxes every time you get paid. A good rule of thumb is to set aside 25% to 30% of your income for taxes. You can use a separate savings account for your tax money and transfer it there as soon as you get paid. You can also use a tax software or a professional tax preparer to help you estimate how much you owe and adjust your savings accordingly.

Not getting professional help

Taxes can be complicated and confusing for freelancers and independent contractors. If you are not sure how to file your taxes correctly, it may be worth hiring a professional tax preparer or accountant who specializes in self-employment taxes.

Maverick freelancers may think that they can do their taxes on their own or that they can't afford to hire a professional. They may also be afraid of trusting someone else with their financial information.

A professional tax preparer or accountant can help you save money, avoid mistakes, and stay compliant with the tax laws. They can also answer your questions, give you advice, and handle any issues that may arise with the IRS or the state agencies. You can find a qualified and reputable professional by asking for referrals, checking reviews, or using online platforms that connect freelancers with tax experts.

Discover the Benefits of Indy

Indy aims to simplify the freelance life for you. Here's how Indy can assist you in managing your taxes more effectively:

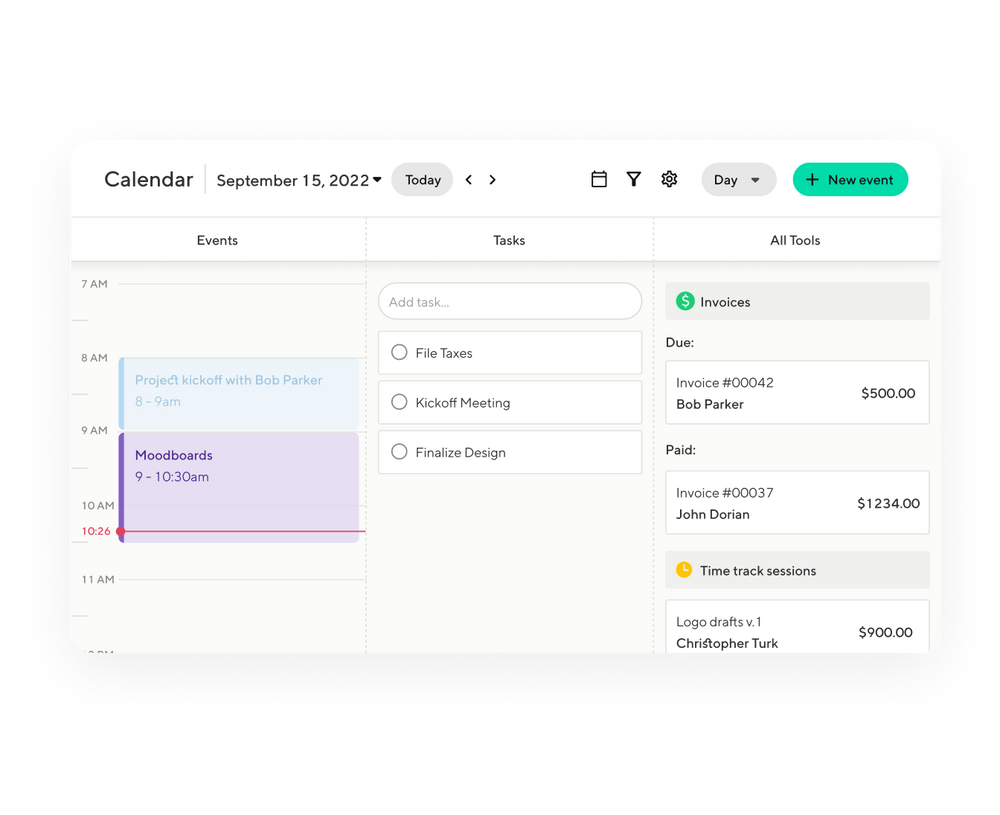

- Utilize Indy's Task Manager for tax-related tasks. Organize your deadlines, create to-do lists, and monitor your progress throughout the year. Set up monthly reminders to arrange your receipts and maintain a well-organized tax filing system.

- Monitor your business transactions with Indy's Invoice feature. This not only expedites your payment process but also provides an overview of your annual income, making it easier to track your financial progress.

Above all, Indy offers a unified platform to streamline various tasks, saving you precious time and effort on administrative work. The time you save can be put into tax deductions or to good use when it's time to file your taxes, making the whole process smoother and more efficient. Sign-up now!

Wrapping It Up

Navigating the complex world of freelance taxes can be a daunting task, but with the right knowledge, organization, and tools, you can avoid common pitfalls and ensure a smooth tax filing experience. By keeping accurate records, setting aside money for taxes, understanding self-employment tax rules, and utilizing platforms like Indy to manage your finances and deadlines, you can take control of your own freelance income and finances and avoid unwelcome surprises from the IRS. With these strategies in place, you can focus on growing your freelance business and enjoying the freedom and flexibility that comes with it.