If you are a freelancer that uses Venmo, Square, and PayPal (or other third-party payment processors) for business transactions, listen up. Digital payment apps will now be required to follow the new tax reporting change for the new 2022 year. These reporting changes go into effect this month, intending to reduce unreported taxable income through these apps. If a significant amount of business transactions go through your apps regularly, now is the time to pay closer attention to each one.

The IRS now requires all digital business payments made on these platforms to be reported on a Form 1099-K. That means that the last “payment received” notification you got is guaranteed to be reported to Uncle Sam. What is more, it is the responsibility of the digital payment app to do the reporting for each of their user’s transactions, defined as a payment for goods or services. Previously, the prior threshold for reporting was 200 transactions per year with a combined gross of total payments of at least $20,000. There may be serious repercussions for any freelancers who have not reported this kind of income in past years since the IRS now requires reporting for each transaction.

The new reporting requirements for the 2022 year are not changing any previous tax responsibilities that freelancers had before this new requirement. That includes claiming all taxable income and tips from clients at the end of the year. Still, it is not the responsibility of the payment apps to report this information. Since the freelancer is considered the head of the business, it is their responsibility to do the task. Whether you are a seasoned writer or just starting as a newbie freelancer, it is important to keep these on the top of your priority list. Make certain transactions and transfers are recorded and carefully kept up.

Keep in mind that this does not include any non-business transactions made. It comes as a relief since paying and getting paid through these convenient apps is the norm and will not be going away any time soon. So, if you are worried about receiving funds from that lunch you had with your co-workers, don’t be. The IRS is interested in making sure all business transactions are being legitimately taxed appropriately.

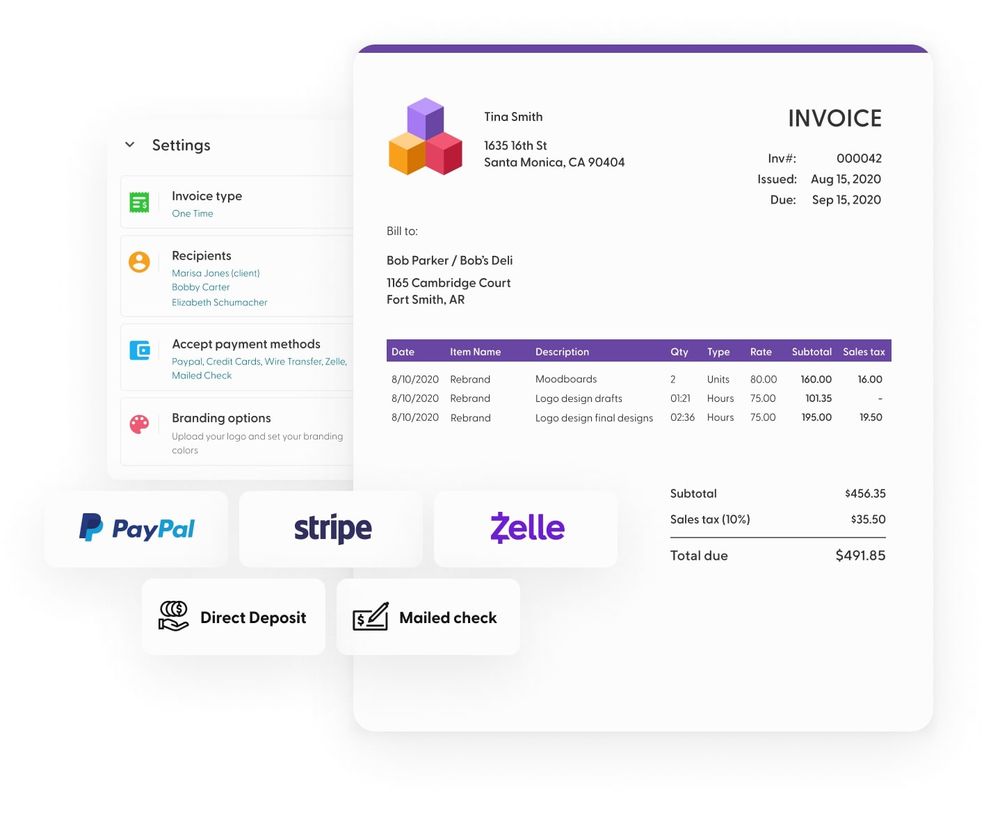

We recommend using a bookkeeping system that allows you to invoice and receive payments from clients. If a new business owner is just not there yet, and perhaps still using a spreadsheet, then it helps to receive payment via Zelle as it is a direct bank payment and won't necessitate a 1099K.

These new freelancing tax changes have made it easier than ever for digital payment transactions to be accounted for. It is advised for all freelancers to proactively report all income, even from apps like Venmo and PayPal. With a clear snapshot of transactions and payment flow, the IRS can easily see how much you receive through payment platforms. Just note, if these apps are being used for bringing in business funds, both freelancers and businesses alike are responsible for reporting these transactions too.

One thing to look out for is if you are using digital payment apps for any transactions that are non-business and receiving a 1099 for it. Be prepared to shed light on any money activities that are personal with the IRS. Another thing to watch out for is the chance that some transactions may have been accounted for twice or even reported inaccurately. There is a chance that this may happen since these freelancer tax regulations for 2022 are brand new. Be sure to review all the 1099s you receive from payment applications as well as from clients who are using them to wire your payment. This can be another possible situation where you may be required to explain to the IRS there are two 1099 forms for the same business transaction.

The best advice for freelancers and every other business using payment apps is to be vigilant to keep records of every dollar that comes in. It cannot be stressed enough how important it is to track all transactions (and business expenses for that matter) to save headaches when tax season comes around. Even though it is up to each payment application provider to enforce these new tax rules, it is still a good idea to have it on record for yourself. Keep an eye out for any notifications sent from these platforms soon requesting further tax information you will need to provide.

A few other important tax updates rolling out in 2022 for freelancers include changes to income thresholds for marginal tax rates and deductions as well as due dates. Observing the next wave of the pandemic on the rise, be advised these dates can change as we have experienced in the last few years. We will try our best to keep you in the loop for any changes in these deadlines. Check out the ones the IRS has announced so far below:

January 18, 2022 – Last day for the Q4 2021 estimated tax payments

January 31, 2022 – Last day for clients to send out W-2 or 1099-NEC/1099-MISC forms to freelancers

March 15, 2022 – Last day for LLCs that are taxed as a partnership (partnership tax returns) and S-corporation tax returns

April 18, 2022 – Last day to turn in 2022 Q1 estimated tax payments. It is also the last day for sole proprietor (businesses you report on a schedule C), C-corporation, and individual tax returns. Deadline extensions need to have a completed Individual Tax Return Extension Form turned in by this day as well.

June 15, 2022 – Last day for the 2022 Q2 estimated tax payments

September 15, 2022 – Last day for the 2022 Q3 estimated tax payments

October 17, 2022 – Last day for 2021 individual tax returns that received a filing extension from the IRS

*Side note: A lot of taxpayers think that filing an extension exempts them from paying their tax debt until the date in which they file their tax return. However, the debt begins accruing interest after the original tax deadline of 4/18/22. That said, if you think you are going to owe, you should make an estimated payment at the time you apply for an extension.

The Standard Deduction for 2022:

- For married couples filing jointly for the tax year, 2022 rises to $25,900, up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Marginal tax rates for 2022:

- The top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

- 35%, for incomes over $215,950 ($431,900 for married couples filing jointly)

- 32% for incomes over $170,050 ($340,100 for married couples filing jointly)

- 24% for incomes over $89,075 ($178,150 for married couples filing jointly)

- 22% for incomes over $41,775 ($83,550 for married couples filing jointly)

- 12% for incomes over $10,275 ($20,550 for married couples filing jointly).

- The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less ($20,550 for married couples filing jointly).

Prior to the passage of the TCJA, workers incurring job-related expenses were able to deduct expenses that exceeded 2% of their AGI. Now, you must fall into one of four categories to be able to claim job-related expenses. You must be either an armed forces reservist, a qualified performing artist, a state or local government official working on a fee basis, or an employee with impairment-related work expenses.

Overall, if you are a 1099 earner, it is likely more advantageous for you to claim the standard deduction.

If you’re filing as a single taxpayer for the 2021 tax year—or you are married and filing separately—you will likely be better off taking the standard deduction of $12,550 ($12,950 for 2022) if your itemized deductions total less than that amount.

The same applies to a married couple filing jointly who have no more than $25,100 ($25,900 for 2022) in itemized deductions and heads of household whose deductions total no more than $18,800 ($19,400 for 2021).21

These deductions almost doubled starting in 2018 after the passage of the TCJA.19

Be sure to contact your tax professional soon for even more in-depth information on the latest freelancer tax changes for the new year. For further help, check out IRS.gov and keep up with the latest news. Be sure to carefully track all business transactions from payment processing apps for a smoother 2022 tax year.

Sources:

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://www.irs.gov/pub/irs-drop/rp-21-45.pdf

https://www.investopedia.com/articles/taxes/08/itemized-deductions-overview.asp