A Profit and Loss Statement (P&L), also known as an income statement, is a critical financial document that summarizes the revenues, costs, and expenses incurred during a specific period of time. The Profit and Loss Statement allows businesses to calculate net income, providing insights into the profitability of the company.

The Profit and Loss Statement helps assess financial performance, monitor business health, guide decision-making, attract investors, evaluate efficiency, and ensure compliance with accounting standards. The P&L Statement is a fundamental tool for understanding a company's profitability and overall financial status. In this article, you will learn about the common elements of a Profit and Loss Statement, the importance of this financial document for business owners, and the best practices for creating a well-structured Profit and Loss Template.

What Are Profit and Loss Statements?

Profit and Loss Statements, also known as Income Statements, are financial documents that provide a summary of your income, expenses, and net profit or loss over a specific period. These statements offer an overview of the financial performance of your business and help you assess its profitability.

Profit and Loss Statements vary from business to business, but there are certain elements that tend to remain consistent. Generally speaking, these statements include an income section, cost of goods sold (COGS) section, business expenses, taxes, and net profit. Additionally, most P&L Statements will also include a breakdown of sales by product or service type. They also help to predict future business performance.

By assessing the profitability of each product or service type, you can make informed decisions about pricing structure and marketing efforts. Additionally, you can pinpoint areas where expenses related and total costs need to be reduced in order to maximize your profits and total revenue.

Overall, a Profit and Loss Statement is an invaluable tool for any business. By taking the time to analyze these documents regularly, you can make adjustments to your strategies and operations in order to maximize profits and ensure long-term financial success. With the proper use of this data, any business can achieve the financial success they desire.

The Common Elements of a Profit and Loss Statement

Typically, a Profit and Loss Statement includes the following sections:

- Sales: This is the revenue from the goods or services sold by the company.

- Cost of Goods Sold (COGS): These are the direct costs related to the production of the goods and services sold by a company.

- Gross Profit: This is calculated as Sales (Total Revenue) minus COGS. It highlights the efficiency of the production and pricing process.

- Operating Expenses: These include overhead and operational costs that are not directly tied to production.

- Operating Profit (EBIT): This is calculated as Gross Profit minus Operating Expenses. It shows the profitability for standard business operations, regardless of financing structure or tax environment.

- Net Profit: The final line, showing the total earnings (or losses) when subtracting all costs, including taxes and interest, from the company's income. It is also known as "Free Profit" but is not a standard financial term or accounting concept. The correct term is "Net Profit."

Importance of a Profit and Loss Statement

The Profit and Loss Statement is an essential tool for business owners and investors alike. It provides vital information about a company's ability to generate profit by increasing revenue, reducing costs, or both. Regular monitoring of a P&L statement can provide early warning signs of potential trouble and an opportunity to correct course before minor issues escalate into major problems.

Profit and Loss Statements serve as a roadmap that gives a clear picture of the company's financial health, guiding strategic decisions that impact the company's bottom line. It is an invaluable tool for small business owners.

Here are some other major benefits of creating a Profit and Loss Statement:

- Financial Planning: These statements help small business owners understand their revenue streams and expenses, allowing them to plan their finances better and set goals for the future.

- Tax Reporting: Small business owners use Profit and Loss Statements to calculate their taxable income and determine the amount of taxes owed to the government.

- Evaluating Business Performance: By analyzing these statements regularly, small business owners can identify trends, measure their business's profitability, and make informed decisions to improve their financial situation.

- Applying for Loans or Credit: Lenders often require Profit and Loss Statements as part of the documentation to assess the small business owner’s creditworthiness.

- Tracking Business Growth: Over time, comparing Profit and Loss Statements from different periods can show small business owners how their business is growing or help them identify areas for improvement.

Additionally, working with a professional accountant can ensure accuracy and compliance with tax regulations, especially if your financial situation becomes more complex.

Best Practices for Writing a Profit and Loss Template

When preparing a Profit and Loss Statement, there are a few best practices you should keep in mind:

- Keep your statement up-to-date and as accurate as possible.

- Structure your statement to make it easy for readers to understand the numbers quickly and easily.

- Provide explanations of any unusual or one-off items in the statement.

- Include any notes that explain assumptions made when calculating figures.

- Balance the statement so that total income and expenses match; if not, provide an explanation for the difference.

- Compare your year-over-year results to track progress and identify potential areas of improvement or cost savings.

- Use comparative statements to compare performance against prior periods or industry benchmarks.

By following these best practices, you can ensure that your Profit and Loss Statement accurately reflects the financial health of your business and helps you make informed decisions about future investments and growth opportunities.

Additionally, having a detailed understanding of your business finances allows you to identify potential tax benefits and other cost savings that can help improve your company's bottom line. Taking the time to craft an effective, accurate P&L Statement is an important step for any business owner.

Profit and Loss Templates

When creating a Profit and Loss Statement, having a straightforward template is essential. Fortunately, there are a variety of options available depending on your specific needs. For example, most accounting software programs come with templates that you can customize to suit your business' particular situation.

Additionally, there are many free and paid templates available online for those who prefer to create their documents from scratch. Whichever route you choose, having the right template makes creating a P&L Statement much easier and more efficient.

We can help guide you in creating a Profit and Loss Statement (also known as an Income Statement) and provide a basic template that you can use as a reference. You can create the template in spreadsheet software like Microsoft Excel, Google Sheets, or any other similar application.

Here's a basic Profit and Loss Statement Template with some common elements:

[Your Company Name]

[Month/Fiscal Year]

Income:

- Sales/Revenue

- Cost of Goods Sold (COGS)

- Gross Revenue/Profit

Expenses:

- Operating Expenses

- Salaries and Wages

- Rent/Lease

- Vehicle Expenses

- Utilities

- Marketing and Advertising Supplies

- Depreciation and Amortization

- Other Operating Expenses

- Interest Expense

- Taxes

Total Expenses

Net Income

Instructions:

- Replace [Your Company Name] with the actual name of the company and [Month/Year] with the relevant month and fiscal year for the statement as a reporting period.

- Under the "Income" section, list all the sources of income for your business, such as sales revenue, service revenue, etc.

- Subtract the "Cost of Goods Sold (COGS)" from the total income to calculate the "Gross Profit." COGS includes the direct costs associated with producing goods or services or units sold by your business.

- Under the "Expenses'' section, list all the categories of incurred business expenses. These may include operating expenses like salaries, rent, utilities, marketing, office supplies, etc. Also, include interest expenses and taxes.

- Calculate the "Total Expenses" by summing up all the expenses listed.

- Subtract the "Total Expenses" from the "Gross Profit" to arrive at the "Net Income." If the result is a positive value, it represents that the business has profited, while a negative value indicates a loss.

Please note that this is a simple template and may not cover all the specific items in your business. Depending on your industry and business model, you may need to customize and add more line items to the statement.

For more accurate and comprehensive financial statements, it's recommended to seek assistance from a professional accountant or financial advisor. They can help you tailor the statement to your business and ensure compliance with accounting standards and regulations.

What Else Should You Know?

Here you will find the basic concepts you should know in relation to Profit and Loss Statements.

Net Income

Net Income, also known as net profit or the bottom line, is a key metric on the Profit and Loss Statement (Income Statement). It represents the residual profit remaining after deducting all expenses from the total revenue earned during a specific period (usually a month, quarter, or year). Net income is a crucial indicator of a company's financial performance to determine profitability showing the company's financial health.

The formula to calculate it is:

Net Income = Total Revenue (Sales) - Total Expenses

Here's a brief explanation of the components:

- Total Revenue (Sales): This includes all the income generated from the core business activities of the company, such as sales of products or services. It does not include any non-operating income, like interest from investments.

- Total Expenses: This comprises all the costs and expenditures incurred by the company during the period. It includes both operating expenses (e.g., salaries, rent, utilities, marketing) and non-operating expenses (e.g., interest expense, taxes).

When the Total Revenue exceeds the Expenses, the result is a positive Net Income, indicating that the company made a profit during the period. Conversely, when the Total Expenses exceed the Total Revenue, the result is a negative Net Income, indicating a loss for the time period.

It is a critical metric for investors, shareholders, and management, as it provides insight into the company's ability to generate profits and maintain financial health. Positive net income demonstrates a financially sound business, while negative net income raises concerns about the company's sustainability and profitability.

Net Revenue

Net Revenue, also known as Net Sales or Revenue Net of Discounts/Returns, refers to the total revenue a company earns from its core business activities after deducting any returns, discounts, and allowances. It represents the actual income a company earns from selling its products or services, excluding any adjustments or refunds.

The formula to calculate Net Revenue is:

Net Revenue = Gross Revenue - Returns - Discounts - Allowances

Here's a brief explanation of the components:

- Gross Revenue (Gross Sales): This is the total revenue generated from sales before any deductions.

- Returns: This refers to the value of goods or services that customers have returned to the company for various reasons, such as defects or dissatisfaction.

- Discounts: These are reductions in the selling price offered to customers to incentivize purchases or for other promotional purposes.

- Allowances: Allowances are adjustments made to the selling price due to specific circumstances, like damaged goods or pricing errors.

By subtracting the returns, discounts, and allowances from the gross revenue, you arrive at the Net Revenue. Net Revenue provides a more accurate picture of the company's core operational performance, as it reflects the revenue generated from actual sales transactions.

Net Revenue is a critical metric for understanding a company's ability to generate revenue effectively and its overall sales performance. It helps assess the company's sales strategy, customer satisfaction, and market demand for its products or services.

Business Revenue

Business Revenue, also known as sales revenue or simply revenue, refers to the total income generated by a company from its primary business activities. It represents the money earned from selling products, providing services, or any other income generated directly from the company's core operations.

Business Revenue is a critical metric for assessing the company's financial performance and measuring its ability to generate income. It is the starting point for calculating various financial ratios and evaluating the company's overall profitability.

Business Revenue can come from different sources, including:

- Sales Revenue: This is the income generated from selling goods or products to customers.

- Service Revenue: This includes income generated from providing services to clients or customers.

- Rental Income: If the company owns properties or assets that are rented out, the rental income is also considered part of the business revenue.

- Licensing and Royalties: Income earned from licensing intellectual property or collecting royalties on the use of patents, trademarks, or copyrights.

- Other Operating Income: This includes any other income derived from the company's core operations, such as commissions, fees, or subscriptions.

Business Revenue is reported on the company's income statement (Profit and Loss Statement) and is a crucial figure for investors, shareholders, and management. It reflects the company's ability to generate sales and provides insights into its market position, customer demand, and overall financial health.

It's important to note that Business Revenue represents the total amount earned before any deductions for costs, expenses, taxes, or other items. To determine the company's profitability accurately, various expenses, including the cost of goods sold (COGS) and operating expenses, must be subtracted from the revenue to calculate the company's net income or profit.

Gross Revenue vs. Gross Profit

Gross Revenue and Gross Profit are two important financial metrics used to assess a company's financial performance, but they represent different aspects of a company's operations.

- Gross Revenue: Gross Revenue, also known as Gross Sales or Total Revenue, refers to the total income a company generates from all its sales before any deductions. It includes all the money earned from selling goods, providing services, or any other primary business activities. Gross Revenue represents the overall scale of a company's sales without considering any costs or expenses associated with production or operation.

Formula to calculate Gross Revenue: Gross Revenue = Total Sales of Goods or Services

- Gross Profit: Gross Profit is the amount of money a company earns from its core business activities after deducting the direct costs associated with producing the goods or services sold. It provides insights into a company's ability to generate revenue while controlling its production costs.

Formula to calculate Gross Profit: Gross Profit = Total Revenue (Sales) - Cost of Goods Sold (COGS)

Here's a brief explanation of the components:

- Total Revenue (Sales): This is the total income generated from selling products or services before any deductions.

- Cost of Goods Sold (COGS): COGS includes all the direct costs directly associated with producing the goods or services sold by the company. It typically includes expenses like raw materials, direct labor costs, and manufacturing overhead.

By subtracting the COGS from the Total Revenue, you arrive at the Gross Profit. This figure represents the profit a company makes from its core business operations before accounting for other operating expenses such as salaries, rent, marketing, and administrative costs.

In summary, Gross Revenue is the total income earned from sales before any deductions, while Gross Profit is the profit generated from sales after subtracting the direct production costs. Both metrics are essential for understanding a company's financial performance, but they serve different purposes in evaluating a company's profitability and efficiency.

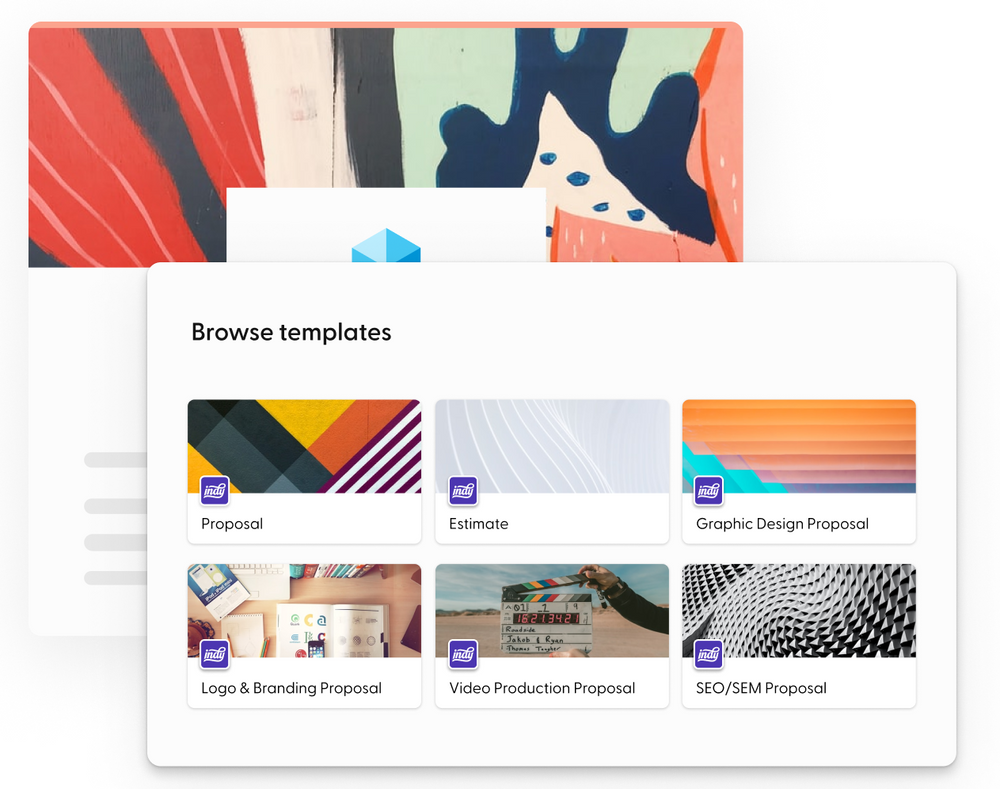

How Can Indy Help?

With Indy's intuitive invoicing and payment features, freelancers and small business owners can quickly generate professional invoices for clients and easily track and organize their project-related income and expenses. By integrating the financial data from Indy into your Profit and Loss Statements, you’ll get a holistic view of your financial performance.

With Indy's time-saving and user-friendly functionalities, creating comprehensive Profit and Loss statements becomes an efficient process for freelancers and small businesses alike. Get started today for free!

A Small Recap

A Profit and Loss Statement is a powerful tool that allows business owners to assess the financial health of their organization and make informed decisions about investments, pricing, marketing, and more. By following best practices for creating these statements and regularly reviewing their content, businesses can ensure that they stay on track for long-term profitability. Additionally, they can take advantage of cost savings and other opportunities to maximize their bottom line.

Taking the time to understand a Profit and Loss Statement is an essential step for any business that wishes to remain successful in today's constantly changing market. For an easier way to manage your business’ invoicing and payments, get started with Indy for free!