Unpaid invoices can be a major cause of financial strain for businesses. If you are having difficulty getting customers to pay their invoices on time, it might be necessary to charge late payment fees. A late payment fee is an effective way to encourage prompt payment and improve cash flow. However, there are certain considerations that must be taken into account when implementing a late fee policy, such as invoice late fee wording and ensuring compliance with relevant laws.

In this article, we will walk you through the essential steps of setting up a late fees policy, provide useful wording examples, and equip you with valuable insights to handle late payments with confidence and professionalism. By the end, you'll be well-prepared to navigate the delicate balance between preserving client relationships and ensuring your business's financial security. Let's dive in!

How to Charge Late Payment Fees Legally

Before implementing a late fee policy on overdue invoices, it is important to understand the laws and regulations that govern how late fees can be charged. Depending on where your business operates, different rules may apply regarding the amount and type of fees you can charge customers for overdue payments. For example, some jurisdictions limit the maximum rate at which businesses are allowed to charge interest or impose other restrictions on charging late fees.

It is also important to ensure that any charges are clearly communicated in writing before invoices are issued so that customers are aware of their obligations in advance. In addition, you must make sure your fee structure complies with applicable consumer protection laws designed to protect buyers from unfair billing practices. By taking time to research relevant regulations and ensuring compliance with all applicable laws before setting up a policy, you will help safeguard your business's reputation while protecting its financial interests as well.

Navigating the landscape of late fees requires a solid understanding of the laws and regulations governing this practice. While implementing late fees can be beneficial for businesses, it's essential to proceed with caution to avoid potential legal pitfalls. This section will provide an overview of the key legal considerations you should be aware of when charging late fees on invoices.

- Check Local and National Laws: The first step is to research the laws and regulations regarding late fees in your specific region. Different countries, states, or provinces may have varying rules governing late payment penalties. Ensure you comply with the applicable laws to avoid any legal repercussions.

- Contractual Agreements: When establishing late fee policies, it's crucial to include clear and detailed terms in your contracts and invoices. Ensure that clients or customers are aware of the late fee policy before any transactions occur.

- Reasonableness of Late Fees: Laws may impose limits on the amount or percentage of late fees you can charge. These limits are often in place to protect consumers from excessive penalties. Review and understand the maximum allowable late fees to stay compliant.

- Grace Periods: Some jurisdictions may require businesses to provide a grace period during which late fees cannot be applied. Familiarize yourself with any mandatory grace periods and incorporate them into your policy.

- Consumer Protection Laws: In certain cases, consumer protection laws may apply, especially when dealing with individual consumers rather than businesses. These laws might grant consumers additional rights and restrictions concerning late fees.

- Unfair or Deceptive Practices: Be cautious about using late fees as a punitive measure or to exploit customers. Charging late fees solely to generate revenue rather than to compensate for actual damages may be considered unfair or deceptive.

- Waiving Late Fees: Decide whether you'll allow exceptions or waivers for specific circumstances. Understand the implications of selectively waiving late fees, as it could set a precedent or be viewed as discriminatory.

- Collections and Legal Actions: Familiarize yourself with the procedures for collecting late payments or pursuing legal action against clients who consistently fail to pay. Engaging in debt collection or legal actions requires adherence to specific laws.

- Consistency and Transparency: Consistently apply your late fee policy to all customers to avoid potential claims of discrimination. Transparency in communicating the policy will also help build trust with your clients.

- Consult with Legal Professionals: When in doubt or facing complex legal questions regarding late fees, it's always best to consult with legal professionals experienced in business and contract law.

Remember that legal requirements and regulations can change over time, so it's essential to stay updated and adapt your late fee policy accordingly.

By understanding the laws and regulations surrounding late fees, you can confidently implement an effective late fee policy while safeguarding your business and maintaining positive client relationships.

Decide on an Appropriate Fee Amount

Determining an appropriate fee amount for late payments requires a careful balance between encouraging prompt payment and avoiding excessive penalties that could alienate clients. Here are some steps to help you decide on an appropriate late fee amount:

- Research Industry Standards: Start by researching what late fees are commonly charged in your industry. Look at your competitors and similar businesses to get an idea of the prevailing practices.

- Consider Your Expenses: Impact Calculate the actual costs and impact of late payments on your business. Late payments can cause cash flow disruptions, increased administrative work, and potential financial strain. Your late fee should cover these costs without being punitive.

- Percentage or Flat Fee: Decide whether you want to charge a percentage-based late fee or a flat fee. Percentage-based fees can be tied to the outstanding invoice amount, while flat ones offer a consistent penalty regardless of the invoice size.

- Set Up Reasonable Late Payment Fee: Ensure that your late fee is reasonable and proportional to the unpaid amount. Charging an excessive fee might lead to disputes and damage your business's reputation.

- Legally Compliant: Make late payment fees legal. Ensure that your late fee amount complies with local laws and regulations. Avoid charging fees that exceed legal limits or could be deemed unfair under consumer protection laws.

- Offer Grace Periods: Consider providing a grace period for late payments before applying the fee. This gesture can demonstrate goodwill while still encouraging timely payments.

- Communicate Clearly: Clearly state your late fee policy in your contracts and invoices. Transparent communication ensures that clients are aware of the consequences of late payments.

- Consider the Client Relationship: Factor in the nature of your relationship with the client and how much interest you put in doing business with them. For long-term, valued clients, you may choose to be more lenient or offer occasional waivers.

- Review and Adjust Payment Terms: Regularly review your late fee policy to assess its effectiveness. If you notice a pattern of late payments or customer dissatisfaction, consider adjusting the fee amount as needed.

- Balance Client Retention and Deterrence: Strive to strike a balance between retaining clients and discouraging late payments. While late fees are essential for financial stability, maintaining positive relationships with clients is equally important.

Ultimately, the appropriate late fee amount will vary based on your business's specific circumstances and industry norms. By considering these factors and keeping an open line of communication with your clients, you can establish a fair and effective late fee policy that encourages timely payments while maintaining strong client relationships.

Create a Policy Statement for Your Invoices

When creating a policy statement for invoices, businesses should include information on late fees, grace periods, exceptions or waivers for specific circumstances, and how to pursue legal action if necessary. Late fees should be reasonable and proportional to the unpaid amount, in accordance with consumer protection laws and local regulations.

In addition to specifying the amount of any late fees and applicable grace period, businesses should also communicate clearly about their policy by including it on all invoices.

Clients should understand what will happen if they fail to pay an invoice on time. Businesses may also consider offering discounts or other incentives for timely payments as a way to encourage prompt payment without imposing excessive penalties.

Finally, businesses should regularly review their policy statement to ensure that it remains up-to-date with any changes in laws or regulations relating to late fees. By adhering to these guidelines, businesses can create an effective policy statement that both encourages timely payments and helps maintain positive client relationships.

How to Write a Late Fee Wording on an Invoice

Here you can find an example of invoice late fee wording you can use in your contract.

At [Your Company Name], we are committed to maintaining a fair and sustainable financial relationship with our valued clients. To ensure smooth operations and timely payments, we have implemented a comprehensive late fee policy for our invoices.

We understand that unforeseen circumstances may arise, impacting payment schedules, and we strive to be considerate and flexible whenever possible. However, to safeguard the financial stability of our business, we must encourage prompt payments.

As per our policy, invoices are due [number of days] days from the date of issuance. Should a payment be delayed beyond this period, a late fee of [percentage/flat fee] will be applied to the outstanding balance. Our late payment fees are designed to cover the costs incurred due to late payments without imposing undue hardship on our clients. Transparency is vital to us, and we aim to communicate the late fee policy clearly on all invoices and contracts.

Rest assured, we value our partnership with you and are always available to discuss any concerns or unique circumstances that may impact your ability to make timely payments. We believe that open communication and mutual understanding form the foundation of a successful business relationship.

Thank you for your continued support, and we look forward to maintaining a positive and mutually beneficial association.

Include Clear Instructions for Invoice Payment Terms

As a business owner or freelancer, invoicing is a crucial aspect of maintaining a healthy cash flow. Timely payments from clients play a significant role in the financial stability of any enterprise. However, late or delayed payments can cause disruptions and strain on your business operations. To facilitate a smooth payment process and encourage clients to make timely payments, it's essential to provide clear and straightforward instructions for invoice payments.

Let’s check out the key components of creating effective payment instructions to ensure your clients settle their invoices promptly and maintain a positive working relationship.

Define the payment due date clearly

One of the primary reasons for late payments is confusion about the due date. Ensure that your invoices clearly state the payment due date, leaving no room for ambiguity. Use phrases like "Due on" or "Payment due by" followed by the specific date to make it evident when you expect the payment. By setting a clear due date, you establish a sense of urgency for clients to fulfill their payment obligations promptly.

Offer multiple payment options

Different clients have varying preferences when it comes to making payments. To accommodate their needs, offer multiple payment methods. Common options include Electronic Funds Transfer (EFT), credit card payments, and checks. Clearly outline the accepted payment methods on your invoice, and consider including icons or logos for each method to enhance visual clarity. This way, clients can easily choose the payment method that suits them best, which can result in faster payments.

Include detailed payment instructions

In addition to listing the payment options, provide step-by-step instructions for each method. For EFT, include your bank account details and any required reference numbers. If you accept credit card payments, mention whether clients should provide the information over the phone or through a secure online portal. For check payments, specify the payee's name and address where the check should be mailed. The more detailed and precise the instructions, the less likely clients are to encounter difficulties when making the payment.

Communicate the consequences of late payments

Make clients aware of the implications of late payments. State your late fee policy clearly on the invoice, outlining the amount or percentage of the late fee and when it will be applied. Additionally, communicate any potential disruptions to services or future business if payments are consistently late. While this should be done professionally and courteously, it helps clients understand the importance of timely payments.

Encourage electronic invoicing (e-invoicing)

Consider adopting electronic invoicing (e-invoicing) to expedite the invoice delivery process. E-invoicing reduces delays caused by postal services and ensures that invoices reach clients promptly. Offer clients the option to receive invoices via email and encourage them to sign up for this convenient and efficient method.

Provide friendly payment reminders

Send payment reminders a few days before the due date. It can serve as a gentle nudge for clients to make the payment on time. These reminders can be via email or even a quick phone call. Just remember to maintain a courteous tone and focus on helping clients stay on track with their payment schedules.

Create a support channel for payment inquiries

Sometimes, clients may have questions or encounter difficulties when making payments. Establish a support channel, such as an email address or phone number, dedicated to handling payment-related inquiries. Respond promptly to any questions or concerns to facilitate a smooth payment process.

Acknowledge receipt of payment terms

Once a payment is received, promptly acknowledge it and send a receipt or confirmation to the client. This reassures them that the payment was successful and helps with their record-keeping. Acknowledging payments also fosters transparency and builds trust between you and your clients.

Clear and comprehensive payment instructions are fundamental to ensuring timely payments for your invoices. By defining the payment due date, offering multiple payment options, providing detailed instructions, and communicating the consequences of late payments, you create an efficient payment process for your clients.

Additionally, encouraging electronic invoicing and offering friendly payment reminders demonstrate your commitment to smooth transactions and customer satisfaction. Remember that effective communication, transparency, and professionalism are key to maintaining positive client relationships and a healthy cash flow for your business.

Make Invoice Late Fee Wording Clear and Understandable

As small business owners or freelancers, maintaining a steady cash flow is essential for the success and sustainability of your venture. However, late or delayed payments can disrupt your financial stability and hinder business growth. To address this challenge proactively, it's crucial to incorporate clear language into your invoice template that explicitly states when late fees will apply.

By setting transparent expectations from the outset, you encourage clients to prioritize timely payments, fostering a smoother and more reliable invoicing process.

Here are the key elements to include in your invoice template to communicate your late fee policy effectively and ensure prompt payments from your clients.

- Specify the Payment Due Date

- Use Bold and Highlighted Text

- Clearly State the Late Fee Policy

- Define Grace Periods (if applicable)

- Highlight the Late Fee Application Method

- Mention Client Support and Communication

- Use Professional Language

Clearly stating your late fee policy in your invoice template is a proactive approach to ensure timely payments and maintain a healthy cash flow for your business.

By setting clear expectations regarding the payment due date, late fee amount, and grace periods (if applicable), you provide clients with all the necessary information to fulfill their payment obligations promptly.

Use bold and highlighted text to draw attention to these crucial details, and maintain a professional tone throughout the template. Remember that effective communication and transparency build trust with your clients, fostering positive business relationships and reducing the likelihood of late payments in the future.

Make It Simple! Consider Automating the Process

For businesses of all sizes, maintaining a healthy cash flow is vital to sustain operations and foster growth. While it's essential to have a clear late fee policy in place, manually assessing and managing late fees can be time-consuming and prone to errors.

To streamline this process and improve efficiency, businesses are increasingly turning to software solutions that automate the assessment of late fees.

Let’s explore the benefits and considerations of implementing such software, empowering you to make an informed decision about automating late fee assessment in your business.

The benefits of automating late fee assessment

- Time Savings: Manually assessing and tracking late fees can be a tedious task, especially for businesses with a high volume of invoices. Automating this process frees up valuable time for you and your team to focus on more strategic aspects of the business.

- Accuracy and Consistency: Software solutions are designed to perform calculations accurately and consistently. By automating late fee assessment, you reduce the risk of human errors and ensure that late fees are applied consistently to all clients.

- Timely Notifications: Automated software can be configured to send timely notifications to clients when their payments are approaching or have passed the due date. These reminders can encourage clients to make timely payments, reducing the occurrence of late payments.

- Flexibility in Late Fee Rules: Many software solutions allow you to set up customizable late fee rules based on your business requirements. You can define different late fee percentages or flat fees for various invoice amounts or payment types.

- Enhanced Cash Flow Management: Automating late fee assessment can significantly improve cash flow management. By encouraging clients to make timely payments, you can reduce the number of outstanding balances and improve overall cash flow.

- Transparency and Client Trust: Automated software generates detailed reports and records of late fee assessments. These records can be shared with clients to provide transparency and build trust in your billing and payment processes.

Considerations Before Implementing Automation

- Software Integration

- Legal Compliance

- Customization and Scalability

- User-Friendly Interface

- Data Security

- Cost vs. Benefit Analysis

Automating the process of assessing late fees with software solutions can be a game-changer for businesses seeking improved efficiency, accuracy, and cash flow management.

The benefits of time savings, accuracy, and timely notifications make automation an attractive option for businesses of all sizes. However, before implementing any software solution, carefully consider factors like integration, legal compliance, customization, data security, and cost vs. benefit analysis.

By making an informed decision and choosing the right software solution for your business, you can streamline late fee assessment, enhance client relationships, and optimize your financial processes for long-term success.

How to Help Customers With Overdue Invoices? Try Automatic Payments or Partial Payments

Late fees can be a source of frustration for both businesses and customers. For businesses, late payments can disrupt cash flow and create administrative burdens. On the other hand, customers may face unexpected challenges that cause payment delays.

To strike a balance between maintaining a healthy financial system and supporting your customers, offering alternative payment options can be a game-changer.

Here are the benefits of providing options such as automatic payments and partial payments to help customers avoid incurring late fees, promoting positive customer relationships and fostering a smoother payment process.

Automatic payments: simplifying the process

One of the most effective ways to help customers avoid late fees is by offering automatic payment options. Automatic payments, also known as recurring payments, allow customers to authorize the deduction of their payment from their chosen payment method on a specific date each month. By opting for automatic payments, customers ensure that their payments are made on time without the need for manual actions. This convenience not only helps customers avoid late fees but also reduces the risk of forgetfulness or missed due dates.

Benefits for customers

- Convenience and Peace of Mind: Automatic payments provide customers with the convenience of "set it and forget it" when it comes to paying bills. They can rest assured knowing that their payments will be made on time, avoiding any potential late fees.

- Better Financial Planning: For customers managing multiple bills and expenses, automatic payments simplify financial planning. They can budget more effectively, knowing that their payments will be automatically deducted on the scheduled date.

- Improved Credit Scores: Timely payments contribute to positive credit scores. Automatic payments can be a valuable tool for customers aiming to maintain or improve their credit history.

Partial payments: flexibility for customers

Another customer-centric option is to allow partial payments. Instead of requiring full payment at once, consider allowing customers to make payments in smaller installments. This flexibility can be especially beneficial for customers facing temporary financial challenges or dealing with irregular income streams.

Benefits for customers

- Reduced Financial Burden: Allowing partial payments eases the immediate financial burden on customers, making it easier for them to manage their payments.

- Preservation of Relationships: By providing the option for partial payments during tough times, you show empathy and understanding, fostering positive customer relationships and loyalty.

- Maintaining Service or Product Access: For businesses offering subscription-based services or installment-based purchases, partial payments can help customers maintain access to the service or product during difficult periods.

Communication and education

To maximize the effectiveness of these options, communication is key. Clearly communicate the availability of automatic payments and partial payment plans to your customers. Provide easy-to-understand instructions on how to set up automatic payments and how to enroll in partial payment plans. Use various communication channels, such as emails, website banners, and customer service representatives, to reach out to your customers effectively.

Seamless integration and security

Ensure that the payment options you provide are integrated seamlessly into your invoicing or billing system. This integration should be user-friendly and easy to navigate for customers of all technical backgrounds. Additionally, prioritize data security to protect customer information and payment details.

Customer support

Offer exceptional customer support to address any questions or concerns related to automatic payments or partial payment plans. Having a dedicated customer support team can help customers navigate through the options and understand the benefits of enrolling in these programs.

Providing options such as automatic payments and partial payments demonstrates a customer-centric approach to billing and helps customers avoid incurring late fees. These options enhance convenience, reduce financial stress, and maintain positive customer relationships.

By proactively offering these solutions and fostering open communication, businesses can create a win-win scenario for both their financial stability and their customers' peace of mind. As a result, late fees become less frequent, and the overall payment process becomes more efficient and customer-friendly.

Unpaid Invoices vs Late Payment Fees: What Are the Consequences?

As a business owner or service provider, timely payments are the lifeblood of your organization's financial health. When clients or customers fail to pay invoices on time, it can have far-reaching consequences beyond a mere delay in receiving funds. Understanding the implications of late payments is crucial for both businesses and clients to maintain positive relationships and ensure smooth operations.

These are some of the consequences of not paying an invoice on time, including the potential additional costs that may result from delayed payment.

- Late Fees and Penalties: One of the primary consequences of not paying an invoice on time is the imposition of late fees or penalties. Many businesses have a clear late fee policy in place to incentivize prompt payments. Late fees are typically expressed as a percentage of the outstanding balance or a flat fee, added to the total amount owed. These fees can accumulate over time, increasing the financial burden on clients and potentially straining the relationship between the business and the customer.

- Cash Flow Disruptions: Late payments can significantly impact a business's cash flow. When invoices remain unpaid, it creates a domino effect, affecting the company's ability to cover operational expenses, invest in growth opportunities, and make timely payments to suppliers or employees. A disrupted cash flow can lead to financial instability and hinder the growth and sustainability of the business.

- Damage to Business Relationships: Consistent late payments can strain relationships between businesses and their clients. Late payments may convey a lack of commitment or financial responsibility on the client's part, leading to trust issues and potential reluctance to engage in future business dealings. Maintaining open communication and addressing payment delays promptly can help mitigate the damage to business relationships.

- Potential Legal Action: In severe cases of non-payment, businesses may resort to legal action to recover the outstanding balance. Legal proceedings can result in costly court fees, attorney expenses, and the potential for negative publicity. Engaging in legal action is time-consuming and can divert resources away from other essential aspects of running the business.

- Credit Rating Impact: Late payments can have adverse effects on both businesses and clients' credit ratings. For businesses, consistently dealing with late payments may affect their creditworthiness, making it challenging to secure financing or favorable terms in the future. Similarly, clients with a history of late payments may face difficulties obtaining credit or loans.

- Loss of Discounts or Benefits: Some businesses offer discounts or incentives for early or timely payments. When clients consistently fail to pay on time, they forfeit these benefits, missing out on potential cost savings or value-added services.

- Service Disruptions or Termination: For businesses providing ongoing services or subscriptions, persistent late payments may lead to service disruptions or, in extreme cases, termination of services. This can disrupt clients' operations and lead to further financial losses.

Understanding the consequences of not paying an invoice on time is essential for both businesses and clients. Late payments can result in late fees, cash flow disruptions, damage to business relationships, potential legal action, credit rating impact, loss of discounts, and even service disruptions or termination.

Open communication, clear late fee policies, and proactive measures to address payment delays can help minimize the negative effects of late payments. Businesses and clients must prioritize prompt and reliable payments to maintain positive relationships and foster a healthy financial environment for all parties involved.

How Should You Handle a Delayed Invoice Payment?

When a client does miss a payment deadline, it's essential to handle the situation professionally. Before charging late fees or hiring a collection agency, reach out to the client to understand the reason for the delay. Sometimes, there may be valid reasons beyond their control, such as unexpected financial difficulties or technical issues with payment processing. Be empathetic and open to finding a solution that works for both parties.

If the late payment becomes a recurring issue, reevaluate the business relationship and consider whether additional measures, such as prepayment or installment plans, are necessary to ensure timely payments.

Implementing a well-structured late fee policy is crucial for any business or freelancer seeking to maintain financial stability and manage cash flow effectively. By setting clear payment terms, sending reminders, calculating late fees accurately, adhering to legal requirements, being consistent, and fostering good communication with clients, you can significantly reduce the impact of late payments on your business.

Remember that while charging late fees can help encourage timely payments, it's essential to balance this with maintaining positive relationships with your clients. Strive for open communication, flexibility, and professionalism to foster long-term partnerships and successful financial management.

How Can Indy Help?

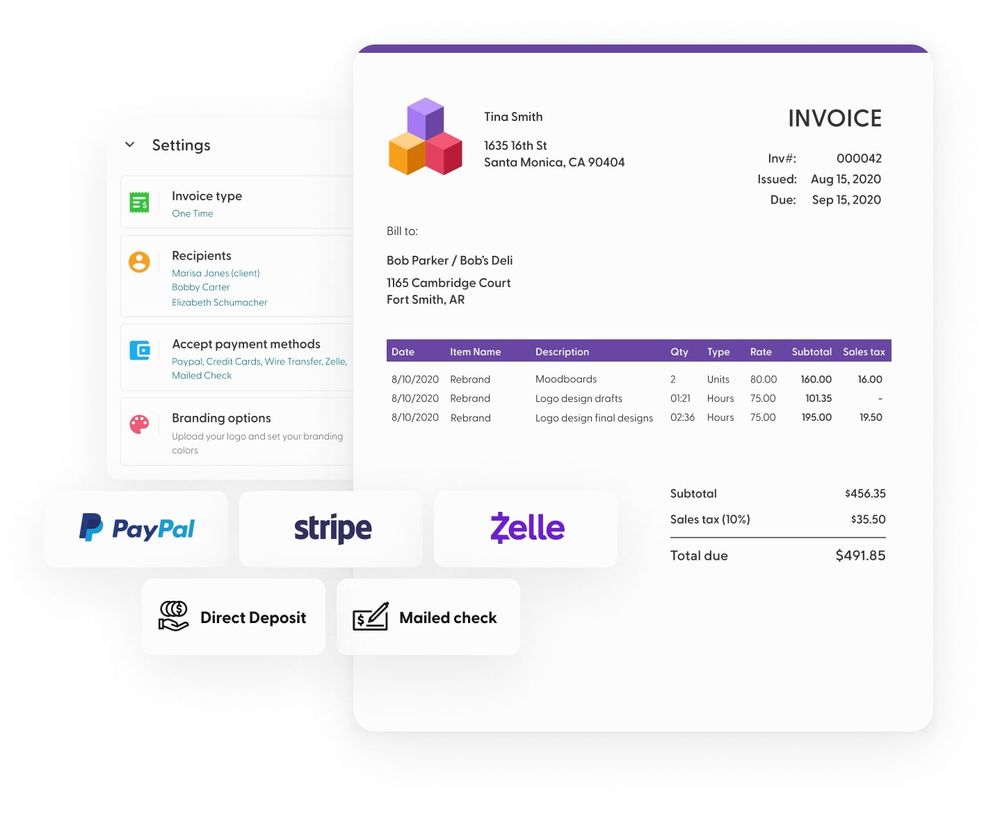

Indy takes the hassle out of payment management. With our legally-vetted contract templates you can effortlessly include late fee penalties, ensuring clients are incentivized to pay on time.

Plus, with our professionally designed invoice templates, you can send automated reminders to any clients who haven’t paid on time, sparing you any awkwardness when making sure a payment doesn’t slip through the cracks.

With Indy's contracts and invoices, you'll have everything you need to streamline your payment process and maintain a healthy cash flow for your business.

Wrapping Up

Implementing a well-structured late fee policy is crucial for any business or freelancer seeking to maintain financial stability and manage cash flow effectively. By setting clear payment terms, sending reminders, calculating late fees accurately, adhering to legal requirements, being consistent, and fostering good communication with clients, you can significantly reduce the impact of late payments on your business.

Looking to prevent late payments? Try Indy’s legally-vetted contract templates to easily add late fees and protect your cash flow. Get started today for free!