Life gets busy, and paperwork can easily slip our minds. But what if that crucial 1099 form, the golden ticket to tax season, has gone MIA? Don't worry; we've got your back.

In this article, we'll share what to do about that missing form and how to get a new 1099 for your tax return. Because, let's be honest, even important paperwork can go missing in the chaos of freelancing.

The Importance of Form 1099

First things first, let's talk about why this slip of paper is a big deal. Your 1099 is not just a fancy tax form; it's your ticket to the IRS show. It declares the income you've earned as a freelancer, and trust us, the taxman wants to know about it.

You'll get your 1099 by January 31st, typically when you've earned at least $600 from a specific source. There are different types of 1099 forms for various income types, and the most common ones are:

- 1099-MISC: The go-to form for reporting miscellaneous income, such as freelance earnings, rent, or prize money.

- 1099-NEC: Specifically designed for reporting nonemployee compensation, including fees, commissions, and other forms of payment to independent contractors.

- 1099-DIV: If you've earned dividends from investments, this form reports those earnings.

- 1099-INT: For those with interest income from sources like savings accounts or bonds, this form has you covered.

- 1099-G: Typically associated with government payments, this form reports unemployment compensation or state tax refunds.

- 1099-R: If you've received distributions from pensions, annuities, or retirement plans, this is the form you'll encounter.

- 1099-B: Investors, this one's for you. It reports proceeds from broker and barter exchange transactions.

- 1099-S: Real estate transactions, including the sale of a primary residence, are reported using this form.

- 1099-C: If you've had debt forgiven or canceled, this form reports the canceled amount, which may be taxable.

- 1099-K: Common for those involved in the gig economy, this form reports income received from payment card transactions and third-party network transactions.

Inside that seemingly innocent form lies the details of your earnings. Losing it isn't just about misplacing paper; it's about losing track of your financial trail.

So, what happens if your 1099 pulls a disappearing act? Well, these are some of the most common repercussions:

- Inaccurate income reporting

- Higher tax liability

- IRS audits

- Penalties and fees

- Delayed refunds

But you don't have to worry too much, because there's a pretty simple solution to this problem.

Steps to Take When You've Lost Your 1099

If you haven't received your 1099 form by early February or have lost it, here's the next steps you should take.

Don't panic – Assess the situation calmly

Take a deep breath. Losing your 1099 doesn't mean the end of the world. Start by retracing your steps. Did it fall victim to the paper monster on your desk, or did it join the ranks of socks lost in the laundry? Stay calm, and let's figure this out together.

Reach out to the payer: Requesting a duplicate 1099

If all else fails and your 1099 is nowhere to be found, what happens next? Fortunately, you can just contact the payer and explain the situation. Whether it's a client or a platform, shoot them a friendly email explaining what happened. Most often, they can provide you with a duplicate 1099. Remember, communication is key, and politeness can work wonders.

Utilizing alternative documents: W-2s, invoices, and payment records

While you wait for that duplicate, gather your financial arsenal. W-2s, invoices, and payment records can serve as valuable substitutes. The IRS just needs to know you're not playing hide-and-seek with your income; you've got it under control.

Reporting a Lost 1099 to the IRS

Time to get serious. What happens if you can't get a replacement 1099 form? There's actually a pretty simple solution.

Understanding your responsibility: Reporting income accurately

The IRS isn't known for its leniency, so make sure you're reporting your income accurately. They're not interested in excuses; they want the facts. Be thorough and honest in documenting your earnings.

Filling out Form 4852 as a substitute for a lost 1099

If you can't get an extra copy of your 1099, that's where Form 4852 comes in—the unsung hero of freelancers who've misplaced their 1099. This form lets you declare your income in the absence of the elusive 1099 document. It's not a golden ticket, but it's the next best thing.

Here's how to get a copy of Form 4852:

- Download from the IRS website: Visit the official website of the Internal Revenue Service (IRS) at www.irs.gov. In the search bar, type "Form 4852," and you'll be able to download the form along with instructions.

- Visit a local IRS office: You can also pick up a copy of Form 4852 at your nearest IRS office. Check the IRS website for office locations and hours of operation.

- Request by mail: Contact the IRS at 1-800-829-1040 to request the form by mail. Keep in mind that this process may take some time, so plan accordingly.

Deadline reminders: Ensuring timely submission to the IRS

Procrastination and taxes don't mix well. The deadline to submit your taxes is April 15, so keep an eye on the calendar, and don't let the deadline sneak up on you. Submit your replacement documents and Form 4852 promptly to avoid unnecessary headaches.

Avoiding Future Issues - Best Practices

Phew! You've recovered from the situation and have everything you need for tax season. Now that we can breathe, here's some tips to help you prepare for next time.

Safeguarding your tax documents: Tips for the future

Learn from this experience and fortify your defenses. Create a designated space for your tax forms, whether it's a physical folder or a secure digital repository. Knowing where your paperwork is can save you from future treasure hunts.

Digital record-keeping: Making tax seasons hassle-free

Embrace the digital age. Scan and save your important documents in the cloud. Not only does it reduce the risk of losing physical copies, but it also makes sorting through your records a breeze. Remember, it's crucial to keep your financial records from the previous tax year. Storing them digitally ensures easy access, helping you stay organized and prepared when tax season rolls around.

Consulting a tax professional for guidance and prevention

When in doubt, seek professional help. Tax professionals aren't just for the elite; they're your allies in navigating the complex world of freelancing. Consult one for advice on keeping your tax game strong. If you decide to hire a tax professional, obtaining an IRS transcript of your past returns can provide valuable insights into your financial history. This will help your advisor come up with a tailored plan for your business as tax day approaches.

Checking for mistakes on your 1099

As you work on strengthening your tax habits, don't forget to scrutinize your 1099 for accuracy. Mistakes happen, and catching them early can save you headaches down the road. Keep an eye out for common errors, such as incorrect income amounts, misspelled names, or inaccurate identification numbers. Double-check your name, address, social security number, and account number. If you spot any discrepancies, don't panic.

Reach out to the issuer promptly and request a corrected form. It's a proactive step that ensures your taxable income is accurately reflected, and tax season unfolds smoothly.

This is crucial not only for your 1099 but for other forms, such as your form W-2, which may be integral to your tax filings if you're still employed. In cases where errors persist and impact your reported income, you may need to consider filing an amended return to rectify the inaccuracies.

How Can Indy Help?

Handling taxes as a freelancer comes with its share of challenges, especially when balancing the responsibilities of running your own business. Yet, Indy makes it a breeze!

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your projects and grow your business.

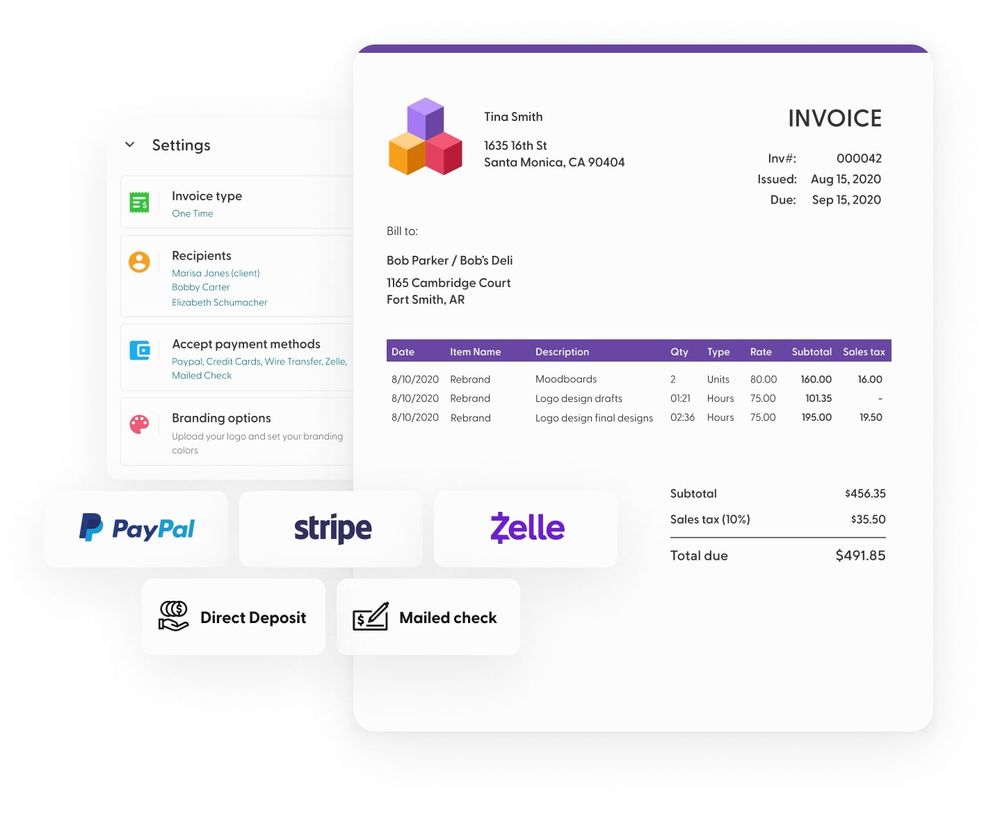

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself. Get started today for free!

A Quick Recap

In the freelancing hustle, losing your 1099 can be a tax season nightmare. Your 1099 isn't just paper; it's your official declaration to the IRS. However, if you do lose your 1099, simply reach out to your client and request a new one. They should be able to easily provide you with a new copy. By embracing best practices, meeting deadlines, and navigating tax seasons with confidence, your taxable income will be under control. And with practical steps and tools like Indy, you're set for freelancing success.

From proposals to project management to invoicing, Indy makes it simple to run your business. Get started today for free!