As tax season draws near, it's time to dive into the annual ritual of decoding tax codes and tackling forms. But don't worry! With a well-crafted tax preparation plan, you can breeze through tax season with confidence.

In this article, we're breaking down our tax prep checklist of 10 steps that'll prepare you for each tax year. This guide is your companion, leading you through every step of the tax preparation process, so you can face the season head-on, well-prepared and stress-free.

Step 1: Gather Financial Documentation

First up, gather every document you need for filing federal, state, and local income taxes. Starting with your personal information:

Personal information

Having these personal details organized and readily available streamlines the tax preparation process:

Social Security Number (SSN) or Taxpayer Identification Number (TIN):

- Collect your SSN or TIN, which serves as a unique identifier for tax purposes.

Proof of Identity:

- Keep a valid form of government-issued identification, such as a driver's license, passport, or state ID.

Current Address:

- Provide your current residential address. If you've moved during the tax year, ensure you have records of both your previous and current addresses.

Contact Information:

- Include your contact details, such as phone number and email address.

Filing Status Details:

- Confirm your filing status, whether you're single, married, head of household, etc. This information influences your tax rates and deductions.

Dependent Information:

- If you have dependents, gather their details, including names, dates of birth, and SSNs.

Collect income documents

As freelancers, our income sources can be as diverse as our skills. So before we dive into the deductions and credits, let's start with the basics - gathering your income documents. This includes your W-2s, 1099s, and any other forms reporting income. Make a checklist of your clients and ensure you have received all the necessary documents. It's better to be proactive in chasing down missing paperwork now than to face complications later.

Income documents:

- W-2 Forms: (If you remain employed while freelancing on the side)

- 1099 Forms: Collect 1099 forms for any freelance work or contract jobs.

- Additional Income Forms: Check for any other income-related forms, such as dividends or interest statements.

- Client Checklist: Create a checklist of your clients and mark off each as you receive their corresponding income documents.

Financial Statements:

- Bank statements for all business-related accounts

- Credit card statements for business-related expenses

- Profit and loss statements (if applicable)

Tax Forms:

- Previous year's tax return

- Schedule C (for reporting business income and expenses)

- Form 8829 (if claiming home office deductions)

Health Insurance Information:

- Documentation of health insurance premiums paid (if applicable)

Retirement Contributions:

- Records of contributions to retirement accounts (e.g., SEP-IRA, Solo 401(k))

Compile expense receipts and records

The lifeblood of tax deductions lies in your expenses. From that cozy home office space to the caffeine-fueled late-night work sessions at your favorite coffee shop, every expense counts. Collect and organize receipts for business-related expenses. Digital tools like expense tracking apps can be a game-changer, saving you time and minimizing the risk of misplaced receipts.

Remember, the more meticulous you are in documenting your expenses, the more deductions you may be eligible for. It's all about maximizing your bottom line and minimizing the taxman's share.

- Home Office Expenses: Gather receipts related to your home office expenses, including rent, utilities, and office supplies.

- Business Travel Expenses: Collect receipts for any business-related travel, including transportation, accommodation, and meals.

- Charitable donations: Maximize your deductions by documenting any charitable donations made throughout the tax year.

- Vehicle Expenses: Mileage log (if using a vehicle for business purposes). Records of vehicle-related expenses (fuel, maintenance).

- Education and Training Expenses: Receipts for education and training directly related to your freelance business

- Digital Receipts: Utilize expense-tracking apps or digital tools to organize and store your receipts digitally.

- Meticulous Documentation: Ensure that each expense is well-documented, providing a clear record for potential deductions.

Explore credits to reduce taxable income

These credits are powerful tools that directly reduce your tax liability, offering a welcome relief for your hard-earned money. Here are some potential tax credits to explore:

- Child Tax Credit: A credit of up to $2,000 per qualifying child under the age of 17.

- Earned Income Tax Credit (EITC): The credit amount varies based on income, filing status, and the number of qualifying children.

- American Opportunity Credit: Available for qualified education expenses, such as tuition and related costs for the first four years of post-secondary education. Maximum credit of $2,500 per eligible student.

- Lifetime Learning Credit: Covers education expenses for undergraduate, graduate, and professional degree courses. Maximum credit of $2,000 per tax return.

- Child and Dependent Care Credit: Available for expenses incurred while caring for a qualifying child under the age of 13. Maximum credit of up to $3,000 for one child or $6,000 for two or more children.

- Saver's Credit: Encourages contributions to retirement savings. Credit amount varies based on filing status, adjusted gross income, and the amount contributed to qualifying retirement savings plans.

Step 2: Review Changes in Tax Laws

As tax laws undergo annual changes, it's important to brush up on the latest rules and regulations.

Staying informed on tax law updates

To stay ahead of the game, make it a habit to stay informed about any updates or modifications to tax laws that might affect freelancers. The IRS website is a goldmine for information, providing resources and publications that break down the complexities into digestible bits.

Understanding how changes affect you

Once you're aware of the changes, the next crucial step is understanding how they impact your specific situation. Tax laws might affect different types of income, deductions, or credits differently. Don't hesitate to consult with a tax professional if needed. Being proactive in understanding these changes ensures you won't be caught off guard when it's time to file.

Step 3: Organize Business and Personal Finances

If you haven't already, making a habit of separating business and personal expenses will help simplify the tax filing process.

Segregating business and personal transactions

Freelancers often find themselves wearing multiple hats, including that of their own accountant. While it's convenient to mix personal and business finances, it can quickly turn into a tangled mess during tax season. Start by creating a clear distinction between your personal and business transactions. Open a separate business account if you haven't already, making it easier to track income and expenses related to your freelance work.

Updating financial statements

Now that you've separated your financial worlds, take a moment to update your financial statements. Reconcile your accounts, ensuring they accurately reflect your income and expenses. Clear and up-to-date financial statements not only facilitate smooth tax preparation but also offer valuable insights into your freelancing business's overall performance.

Step 4: Verify Filing Status

Depending on your filing status, it'll affect how much you owe in taxes or the amount of your tax refund.

Confirming your filing status

Filing status sets the foundation for your tax return. Are you a sole proprietor, LLC, or S-corporation? Confirm your filing status to ensure you're using the correct tax forms and taking advantage of applicable deductions. If your circumstances have changed since last year, such as getting married or starting a family, your filing status may need adjustment. Being proactive in confirming this ensures your tax return accurately reflects your current situation.

Step 5: Calculate Quarterly Estimated Taxes

Tax season varies for employees and freelancers. Unlike employees, freelancers are responsible for covering their own taxes (Social Security and Medicare).

Because of this, being self-employed often requires making estimated quarterly tax payments, covering income tax, self-employment tax, and other taxes. Failing to meet these payments may result in penalties.

Assessing income for estimated tax payments

As a freelancer, your income might not arrive in neatly packaged paychecks, making estimating taxes a bit trickier. Nonetheless, paying quarterly estimated taxes is essential to avoid penalties and surprises come tax filing season. Start by assessing your expected income for the year. Consider both regular and irregular income sources. While it might not be an exact science, a reasonable estimate will help you stay on top of your tax obligations.

Ensuring compliance with quarterly deadlines

Mark your calendar with the quarterly estimated tax payment deadlines: April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties, so it's crucial to stay on track. Setting aside a portion of your income regularly and consistently can make these payments more manageable. If your income fluctuates, consider using the "annualized income installment method" to adjust your estimated payments based on actual earnings throughout the year.

Step 6: Take Advantage of Tax Software or Professionals

In the digital age, tax preparation doesn't have to be a daunting task. Numerous tax software options cater specifically to freelancers.

Evaluating tax software options

Evaluate different platforms, considering factors like user-friendliness, features, and pricing. Look for software that streamlines income and expense tracking, helps you identify deductions, and guides you through the filing process.

Deciding on DIY or professional assistance

Choosing between DIY tax preparation and hiring a professional is a decision every freelancer must make. If your financial situation is relatively straightforward, using tax software might be a cost-effective and efficient option. However, if your freelance business involves complexities, such as multiple income streams, international work, or substantial deductions, enlisting the help of a tax professional could be a wise investment. Consider the value of your time, the complexity of your tax situation, and your comfort level with tax regulations when making this decision.

Step 7: Conduct a Final Review

Before you send everything off, give it one last look through, making sure everything is accurate and free of any errors.

Double-checking all information

Double-check all the information on your tax return, ensuring accuracy and completeness. Pay special attention to numerical entries, social security numbers, and banking details. A simple clerical error could lead to delays or complications. Take the time for a thorough review to catch any potential mistakes.

Resolving any discrepancies

If you discover discrepancies or have questions about your tax situation during the review, address them promptly. Whether it's clarifying a deduction, resolving an unexpected tax liability, or seeking guidance on a specific tax treatment, don't hesitate to reach out to a tax professional. Resolving any discrepancies before filing ensures a smoother and more confident submission.

Step 8: File Electronically or by Mail

Now that you've made sure your information is error-free, there's two different ways you can file your taxes.

Choosing the right filing method

The IRS encourages electronic filing for its speed, accuracy, and security features. Most tax software options support e-filing, making it a convenient choice. Electronic filing also expedites the processing of your refund if you're due one.

Ensuring timely submission

Whether you choose to file electronically or by mail, timeliness is crucial. The tax deadline is typically April 15th, but if that day falls on a weekend or holiday, the deadline is extended to the next business day. Failure to submit your tax return on time can result in penalties and interest, so mark the deadline on your calendar and ensure your submission is completed well before the cutoff.

Step 9: Prepare for Potential Audits

While the idea of an audit may seem scary, maintaining detailed and organized records can be your best defense.

Keeping detailed records for audit defense

Keep copies of all supporting documents, including receipts, invoices, and any other evidence supporting your income and deductions. Staying organized not only facilitates a smoother tax preparation process but also positions you well in case the IRS decides to review your return.

Understanding your rights and responsibilities

In the event of an audit, it's essential to understand both your rights and responsibilities. The IRS has specific procedures for audits, and knowing what to expect can ease anxiety. Consult IRS publications or consider seeking professional advice to comprehend your rights during an audit. Remember, being informed and prepared can turn what seems like a daunting process into a manageable one.

Step 10: Review Your Tax Return

No tax return is perfect, and there's always room for improvement. Identify any challenges or complexities you faced last year and seek solutions. This proactive approach ensures you're continuously refining your tax strategy and adapting to changes in your freelancing business.

How Can Indy Help?

Balancing your freelance business during tax season can be challenging, but using Indy not only simplifies your business processes but also plays a role in lowering your tax costs.

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

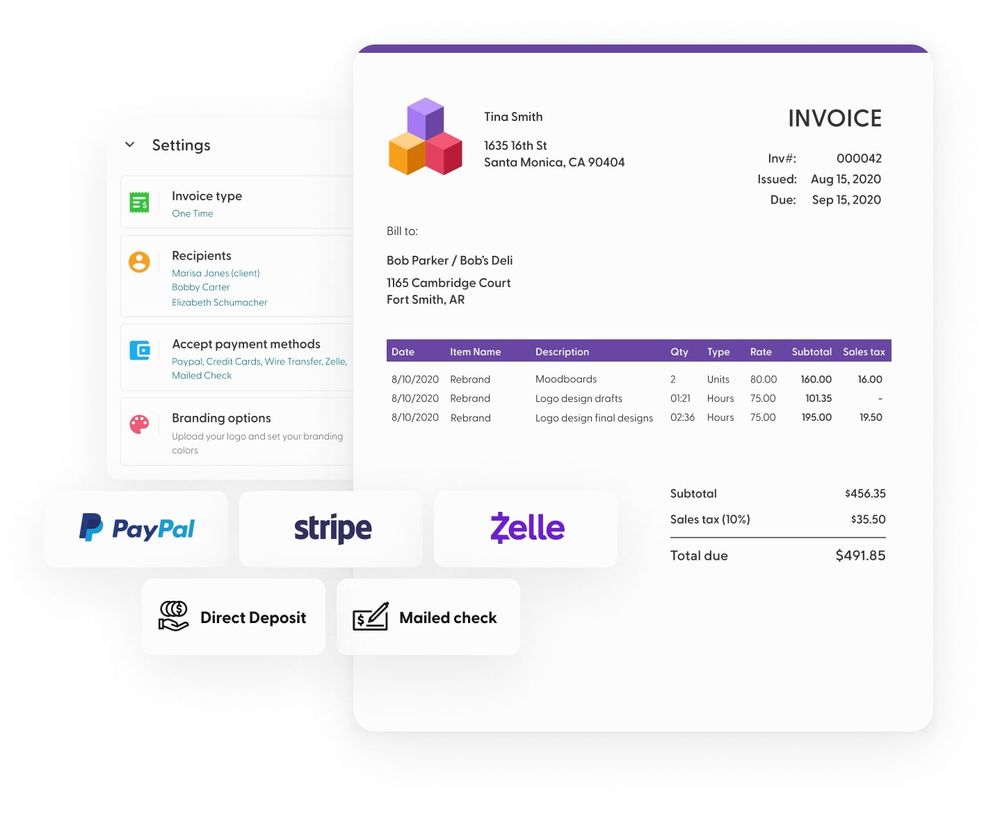

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Let Indy take care of the administrative side, so you can focus on what you do best, creating outstanding projects for clients. Get started today for free!

A Quick Recap

By following the comprehensive 10-step tax preparation checklist outlined in this guide, you're not only arming yourself against potential pitfalls but also positioning yourself to make the most of available deductions and credits. The initial steps, such as gathering financial documentation and organizing business and personal finances, set the foundation for a smooth tax preparation process.

Paying close attention to income documents, compiling expense receipts, and exploring tax credits can significantly impact your bottom line and reduce your tax liability. Once you've filed your tax documents, you can get your tax refund faster with the IRS Direct Deposit Program – it's free, and you can deposit your refund into up to three accounts.

Ready to fast-track your freelance business and maximize tax savings? Get started with Indy for free and manage your entire business under one roof, from contracts to invoicing and everything in between.