Starting a side hustle is exciting, but when tax season arrives, it can be confusing—especially when it comes to navigating the intricacies of self-employment tax. Don't worry, we're here to help!

In this article, we'll walk you through the details of claiming income from your side jobs. We'll share information on self-employment duties, reporting limits, and the necessary forms to file taxes with confidence.

What Are the Tax Obligations for Side Hustles?

The big question is, do you have to pay income taxes on a side hustle? The short answer is, yes. Any income you earn from your side hustle is considered self-employment income.

This includes earnings from freelancing, consulting, selling products, or providing services independently.

Overview of side hustle taxation

Side hustle income is generally taxed differently from traditional employment, mainly due to the absence of an employer withholding taxes for you.

With a side hustle, your income is subject to both income tax and self-employment tax. Income tax is based on your overall earnings, while self-employment tax covers Social Security and Medicare taxes. Being aware of these components will help you plan and budget effectively.

As a self-employed individual, you are required to report this income accurately and calculate your self-employment tax obligations. It's not just about managing your business; it's about managing your tax responsibilities as your own employer.

Navigating self-employment tax

Self-employment tax covers Social Security and Medicare taxes for individuals who work for themselves. Understanding how this tax applies to your freelance income is essential for accurate financial planning. The self-employment tax rate is 15.3%, consisting of 12.4% for Social Security and 2.9% for Medicare. Additionally, there may be an extra 0.9% Medicare tax for high earners.

Managing self-employment tax is a key aspect of freelancing, so be prepared to set aside a portion of your income to cover these obligations (and don't forget about your federal and state tax responsibilities)!

Meeting deadlines for estimated tax payments

Freelancers and side hustlers are responsible for paying taxes on a quarterly basis. These estimated tax payments help you avoid a large tax bill at the end of the year. Quarterly payments typically include income tax and self-employment tax.

The deadlines for quarterly estimated tax payments are:

- January 15

- April 15

- June 15

- September 15

Missing these deadlines can result in penalties, so be sure to stay organized and make timely payments to the IRS.

When Do You Need to Report Income from Side Hustles?

When it comes to navigating the world of side hustle income and taxes, understanding the thresholds for reporting and claiming income can be the determining factor in how you handle your tax responsibilities.

Reporting thresholds for freelancers and side hustlers

The threshold for reporting income is relatively straightforward. As a self-employed individual, you're generally required to report all income earned, regardless of the amount. This includes payments for services rendered, income from freelance projects, and any other sources of self-employment income.

Tip: Keep a meticulous record of all your freelance income, no matter how small. Even if you don't receive a Form 1099-NEC for amounts under $600, it's your responsibility to report these earnings on your tax return.

Tax implications for income below the threshold

While all income should technically be reported, there are scenarios where the IRS may not receive documentation for smaller amounts. However, this doesn't mean you're off the hook. It's in your best interest to maintain accurate records and report all income, as failure to do so can lead to penalties and potential audits.

Tip: Keep thorough records, report all income, and leverage deductions to optimize your tax situation.

Essential Tax Forms for Claiming Income from Side Hustles

Side hustle income requires different tax forms than regular 9-5 employment. Knowing and using these important tax forms helps side hustlers meet their tax duties accurately and efficiently.

Key forms include:

- Form 1099-NEC: Commonly used to report payments made to independent contractors, especially relevant when earnings from a client reach $600 or more.

- Schedule C: Essential for self-employed individuals, this form is used to report business income and expenses, determining the net profit or loss for the side hustle.

- Schedule SE: Crucial for self-employment tax, freelancers use this form to calculate Social Security and Medicare taxes owed on their net earnings.

- Form 1040-ES: Your go-to document for calculating and paying quarterly estimated taxes.

- Form 1099-K: If you receive payments through a third-party platform, like PayPal or a similar service, you may receive a Form 1099-K. This form reports the total payment transactions processed through the platform.

- Form W-2: If you have multiple sources of income, including a part-time job or other freelance gigs, you might receive a Form W-2 from an employer. This form outlines your wages, tips, and other compensation.

- Form 8829: If you operate your freelance business from a home office, this form allows you to deduct certain expenses related to the business use of your home, such as a portion of your rent or mortgage interest, utilities, and home maintenance costs.

How to Claim Income from Side Hustles

So, you've been hustling on the side, whether it's freelancing, consulting, or running a small business alongside your 9-5 job. Now comes the important part: claiming that hard-earned income on your taxes. Let's break down the step-by-step process to ensure you navigate the tax landscape with confidence.

Step 1: Keep meticulous records

Before diving into the tax-filing process, make sure you've maintained detailed records of your side hustle income and expenses. This includes invoices, receipts, and any other relevant documentation. Staying organized from the start sets the stage for a smoother tax-filing experience.

Step 2: Determine your filing status

Your filing status plays a significant role in how you report your side hustle income. Whether you're filing as a sole proprietor, LLC, or another business entity, understanding your status is crucial. If you're unsure, it's advisable to consult with a tax professional to determine the most advantageous status for your situation.

Step 3: Report all income

Regardless of the amount, it's essential to report all side hustle income. This includes earnings from freelance gigs, consulting projects, or any other sources. Even if you don't receive a Form 1099-NEC for amounts under $600, you're still responsible for reporting these earnings on your tax return.

Step 4: Leverage deductions

Maximize your tax savings by taking advantage of eligible deductions. This includes business-related expenses such as office supplies, software subscriptions, and mileage. Keep thorough records of these deductions to substantiate your claims and reduce your taxable income.

Step 5: Complete the necessary tax forms

The specific forms you'll need depend on your filing status and the nature of your side hustle. Common forms for reporting self-employment income include Schedule C (Profit or Loss from Business) and Schedule SE (Self-Employment Tax). If you're unsure which forms to use, seek guidance from a tax professional or utilize tax software tailored to your needs.

Step 6: Pay quarterly estimated taxes

Freelancers and side hustlers often need to pay quarterly estimated taxes to stay current with their tax obligations. Use Form 1040-ES to calculate and pay estimated taxes, helping you avoid penalties for underpayment and ensuring you're on track throughout the year.

Step 7: Stay informed about tax law changes

Tax laws are subject to change, and staying informed is crucial for accurate and compliant tax filings. Regularly check for updates and modifications to tax regulations that may impact your side hustle income.

Step 8: File your taxes on time

Finally, don't forget to file your taxes on time. Missing deadlines can lead to penalties and unnecessary stress. Be proactive in gathering all necessary documents and submitting your tax return by the due date. Remember, you can file either by mail or electronically. Choosing the electronic filing option is often quicker and more convenient, providing a faster processing time for your tax return. Whether you opt for traditional mail or electronic filing, ensuring timely submission is crucial for a smooth tax season experience.

Tax Deductions and Credits for Freelancers

Feeling overwhelmed by the additional 15.3% self-employment tax? Don't worry! Deducting business expenses and taking advantage of tax credits can significantly reduce your taxable income.

Maximizing deductions for freelancers

You can deduct expenses that are essential for your business, like office supplies and professional development courses.

Take the time to identify all possible deductions to maximize your tax savings. Common deductions include business-related travel, meals, and equipment purchases. Keep detailed records and consult the IRS guidelines to ensure you don't miss out on any eligible deductions.

Freelancers often overlook certain deductions, such as the home office deduction, health insurance premiums, and retirement contributions. Familiarize yourself with the full list of eligible deductions to ensure you're not leaving money on the table.

Exploring tax credits for self-employed individuals

Freelancers may be eligible for tax credits, such as the Earned Income Tax Credit (EITC) or the Child and Dependent Care Credit. These credits can reduce your overall tax liability, providing a valuable financial boost.

Specialized deductions for freelancers

Explore specialized deductions that cater to freelancers, such as the Qualified Business Income Deduction (QBI) introduced by the Tax Cuts and Jobs Act, which allows eligible freelancers to deduct up to 20% of their qualified business income from their taxable income. Understanding and leveraging these deductions can lead to significant tax savings.

When Should You Hire a Tax Professional?

Hiring a tax professional as a freelancer makes sense when you have multiple income sources, complex business deductions, or if your earnings vary significantly.

If handling self-employment taxes and various forms feels challenging, a tax professional can bring clarity, peace of mind, and ensure accurate filing.

Benefits of working with a tax advisor

While freelancers can manage their taxes independently, hiring a tax professional offers several benefits. A tax advisor can provide:

- Expert Advice: A tax advisor brings specialized knowledge and expertise, offering valuable insights and guidance tailored to the unique aspects of freelancers' tax situations.

- Compliance Assurance: Ensures compliance with complex and ever-changing tax laws, reducing the risk of errors and potential penalties associated with non-compliance.

- Savings Opportunities: Recognizes opportunities for additional savings by leveraging available deductions, credits, and tax strategies specific to freelancers' circumstances.

Tips for choosing the right tax professional

When selecting a tax professional, consider their experience with freelancers and self-employed individuals. Self-employment taxes involve unique considerations, and an experienced professional is more likely to be familiar with the intricacies of this type of income.

It's also important to check for relevant certifications, such as Certified Public Accountant (CPA) or Enrolled Agent (EA). These certifications show expertise and following professional standards in taxation. Communicate clearly and make sure they understand the specific details of your freelance business.

How Can Indy Help?

Tackling tax season for your freelance gig can be a real challenge, but Indy makes things easier and more cost-effective!

It's not just a tool for streamlining your business tasks; it's also your secret weapon for keeping those tax expenses in check.

Here's how Indy can fast-track your success:

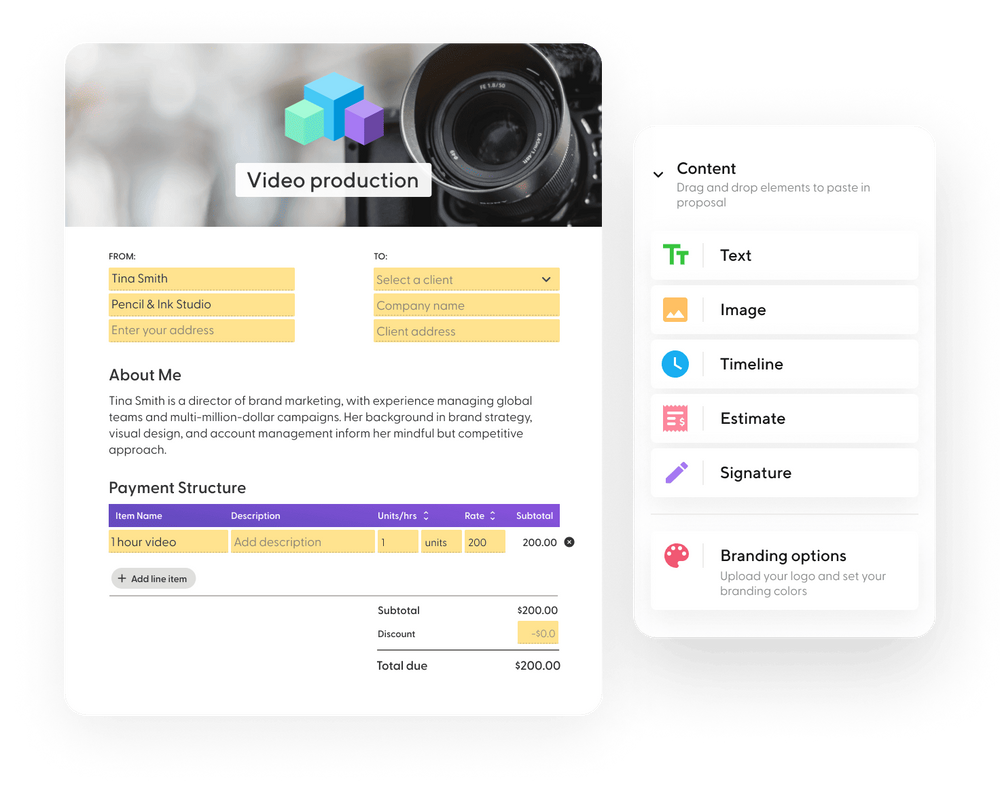

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself. Get started today for free!

A Quick Recap

As freelancers or side hustlers pay taxes, make sure you know about self-employment obligations, reporting limits, and the necessary forms to file correctly. Self-employment taxes mean you have to pay estimated taxes every quarter, keep detailed records, and use deductions to lower your tax bill. Stay organized to save money and follow the rules accurately.

If you're ready to fast-track your independent business and maximize savings, get started with Indy for free! Manage your entire business under one roof, from contracts to invoicing and everything in between.