Ever found yourself pondering, "How much do I actually need to make before Uncle Sam comes knocking?" As freelancers, we revel in the freedom of choosing our projects, setting our schedules, and defining our professional destinies. But in the midst of the exhilarating highs of pursuing our passions, there's a practical reality we can't afford to overlook – taxes.

In this article, we're diving headfirst into the intricacies of tax thresholds and exploring the unique considerations that freelancers face.

Understanding the Thresholds for Filing Taxes

We all want to make a living doing what we love, but when does the joy of earning turn into the responsibility of filing taxes? Well, it all begins with income thresholds.

The basic income thresholds

As of 2023, here’s how the income threshold for filing federal taxes varies based on your filing status:

- For single filers:

- It kicks in at $12,950 for those younger than 65

- If you're 65 or older, it begins at $14,700

- For married filing jointly:

- $25,900 if both spouses are younger than 65

- $27,300 if one spouse is younger than 65 and one is 65 or older

- $28,700 if both spouses are 65 or older

- Married filing separately:

- $5 for all ages

- Head of household:

- $19,400 if younger than 65

- $21,150 if 65 or older

- Qualifying widow(er) with dependent child:

- $25,900 if younger than 65

- $27,300 if 65 or older

However, it's essential to check the latest updates from the IRS as these figures can change.

Self-employment taxes and the gig economy

Now, let's talk about the elephant in the room – self-employment taxes. Unlike our 9-to-5 pals who have employers deducting taxes from their paychecks, we're responsible for paying our own taxes. So, even if your income doesn't reach the thresholds mentioned above, you'll still be on the hook for paying a self-employment tax of 15.3%, which covers your Social Security and Medicare contributions. Keep a close eye on your income because once you hit $400 in net earnings, the taxman comes knocking.

Small business income and tax filing

If your freelancing gig has grown into a small business, congratulations! But with great income comes great responsibility. You might need to file business taxes if your net earnings reach a certain threshold. Keeping your business and personal finances separate isn't just good practice; it helps make tax season a bit less of a headache.

Should You File Taxes Even If You Don't Have To?

As a freelancer, you might find yourself questioning whether it's worth the effort to file taxes when your income falls below the threshold. The short answer? Yes, and here's why.

Unlocking financial opportunities

Filing taxes, even if you're not obligated to, can open doors to various financial opportunities. Many tax credits and deductions are designed to benefit individuals with lower incomes. By filing, you may discover tax breaks that put money back in your pocket, such as the Earned Income Tax Credit (EITC) or education-related credits. These credits are not just for high earners – freelancers with modest incomes may find they qualify and can significantly benefit from filing.

Building a strong financial profile

Consistently filing your taxes contributes to building a robust financial profile. Lenders, landlords, and even potential clients may request tax returns as part of their evaluation process. Having a history of filing taxes demonstrates financial responsibility and stability, which can be advantageous in various aspects of your personal and professional life.

Preparing for the future

While you might not have a substantial income now, your freelancing venture could grow over the years. Filing taxes regularly establishes a habit that will serve you well as your income increases. It also ensures you're familiar with the tax-filing process, making it less daunting as your financial situation becomes more complex.

Avoiding penalties and issues

Even if you fall below the income threshold and, therefore, don't owe taxes, certain situations might make it necessary to file. For instance, if you had self-employment income over $400 or received advance premium tax credits, the IRS might expect you to file. Failing to do so could lead to penalties and other complications down the line.

Taxable Income vs. Gross Income: What Counts?

Knowing the gap between your total earnings (gross income) and what's actually taxable is crucial for maximizing deductions and getting a clear view of your tax responsibilities as a freelancer.

Grasping gross income

Gross income is the total sum of your earnings before any deductions. It includes your salary, freelance payments, and any other income sources. So, when you're wondering if you've hit the tax-filing threshold, think about the big picture – your gross income.

Deductible expenses and adjusted gross income (AGI)

But hold on, not all that money goes straight to Uncle Sam. You get to reduce your taxable income by considering deductible expenses. These could include business-related costs like equipment, travel, or even a portion of your home if you work from there. The magic number here is your Adjusted Gross Income (AGI) – it's the upgraded form of your income, where deductions work to lower the amount you're taxed on.

Additional Factors Influencing Tax Filing Requirements

Beyond income, your age, special circumstances, and tax credits can significantly influence whether freelancers need to file taxes, revealing hidden opportunities within the tax code.

Age and filing requirements

If you're a young freelancer just starting out, you might think you're off the hook. But remember, even if your income is below the threshold, special rules apply to younger taxpayers. On the flip side, seniors, with their wealth of experience, might have additional considerations.

Special circumstances and credits

Life is full of surprises, and sometimes those surprises come with tax benefits. Even if your income is on the lower side, explore tax credits that could put money back in your pocket. Education credits and earned income tax credits – these are like little gifts from Uncle Sam, so don't miss out on them.

Education Credits: If you're a freelancer pursuing higher education or if you're supporting a dependent's educational journey, explore education-related tax credits. The American Opportunity Credit and the Lifetime Learning Credit are two examples that can help offset the costs of tuition and other qualified expenses.

Earned Income Tax Credits (EITC): This particular credit is a game-changer for lower-income freelancers. The EITC is designed to assist individuals and families with low to moderate incomes. The amount of the credit depends on factors like your income and the number of qualifying children you may have. Even if your income is below the filing threshold, it's worth checking your eligibility for the EITC, as it can result in a refund – yes, money back in your pocket!

Penalties for Not Filing Taxes When Required

Finally, let's talk about the less enjoyable side of taxes – penalties.

The cost of non-compliance

Ignoring your tax obligations can lead to financial headaches, including late filing penalties and interest on unpaid taxes. The IRS isn't a friend you want to keep waiting. So, stay on their good side and file on time, otherwise, you could face these penalties:

- Failure-to-File Penalty: If you don't file your tax return by the deadline and you owe taxes, you may face a failure-to-file penalty. This penalty is usually more severe than the failure-to-pay penalty.

- Failure-to-Pay Penalty: If you don't pay your taxes by the filing deadline, you may incur a failure-to-pay penalty. This penalty is generally less than the failure-to-file penalty and accrues on the unpaid taxes over time.

- Interest Charges: In addition to penalties, the IRS charges interest on any unpaid taxes. The interest is typically compounded daily and accrues until the taxes are paid in full.

- Accuracy-Related Penalties: If the IRS determines that your return contains inaccuracies or understatements of income, you may face accuracy-related penalties. These penalties are a percentage of the underpayment caused by the inaccuracies.

- Criminal Penalties: In extreme cases of tax evasion or fraud, criminal charges may be filed, leading to severe penalties, including fines and imprisonment.

Avoiding common pitfalls

Nobody likes paperwork, but when it comes to taxes, it's your best friend. Keep meticulous records of your income and expenses throughout the year. This not only helps you claim all the deductions you're entitled to but also saves you from scrambling to find receipts come tax season. Stay organized, stay stress-free.

How Can Indy Help?

Juggling your freelance business during tax season can be challenging. Yet, platforms like Indy not only simplify business management but also help cut down on your tax expenses.

Let's explore how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

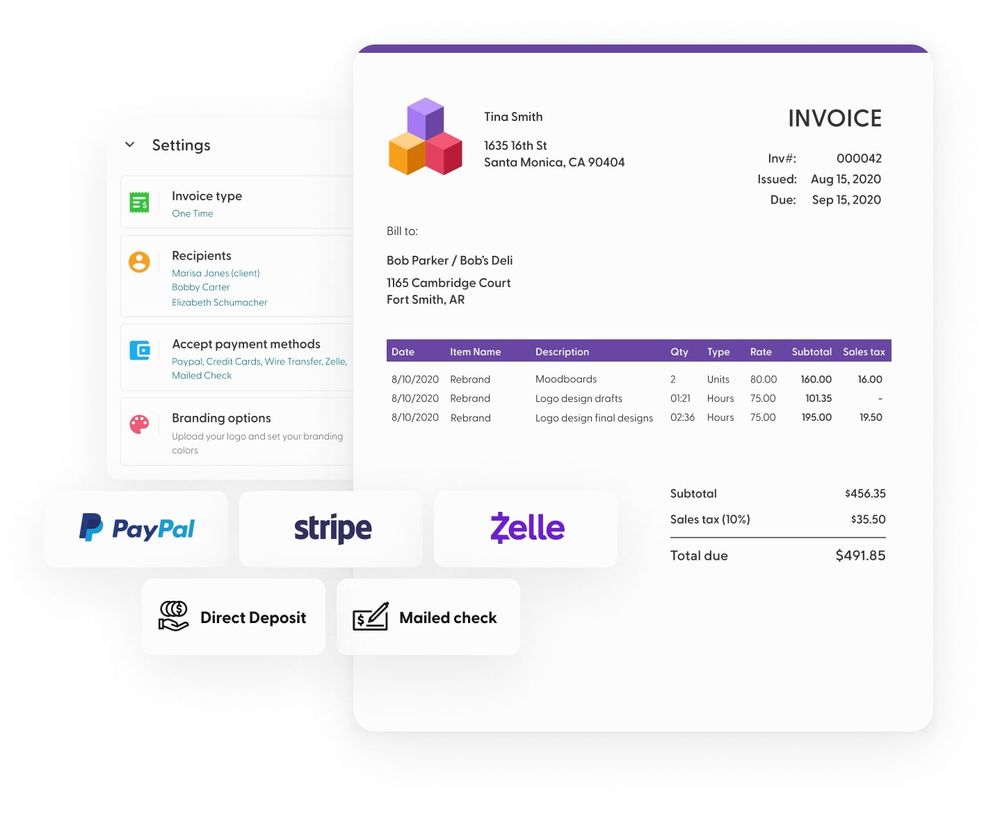

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Get started today for free and let Indy handle the administrative side, so you can focus on what you do best, creating outstanding projects for clients.

A Quick Recap

From understanding your tax obligations to optimizing your deductions, you're well-equipped to navigate the ever-changing terrain of freelance finances and receive your tax refund when the filing season arrives. Filing a comprehensive federal income tax return is a crucial annual task that allows you to report your earnings, claim deductions, and potentially receive a refund based on your financial circumstances.

Not only that but for freelancers, there's an added obligation to make regular estimated tax payments throughout the year (known as quarterly taxes). This ensures compliance with federal tax requirements. Even if your income hasn't reached the threshold required for filing taxes, you may want to file a tax return anyway, as there are many benefits to receiving a federal tax return, such as unlocking financial opportunities, building a strong financial profile, and preparing for the future.

Are you looking to fast-track your freelance business and maximize savings come tax season? Get started with Indy for free and manage your entire business in one place, from contracts to invoicing and everything in between.