Influencers, while sometimes unfairly not regarded, are an independent contractor who are business owners. Whether you're working as an Instagram influencer or a YouTube content creator, you have income that requires you to pay income tax. As such, you must save money and pay self-employment tax on your taxable income.

One of the tax benefits of being classed as a business is that you can take advantage of influencer tax write-offs with tax-deductible expenses. However, you might not know what is potentially available for influencers to save money on their income tax bill. Therefore, in this article, we will be detailing the potential options for influencer tax deductions that can save money and why you need to consider these. We will also explain how Indy can help you manage your tax and other aspects of your Freelancer business.

Why Do You Need to Check Tax Deductions and Tax Write-Offs

Running a business can be difficult, especially in the early stages of the business when cash flow can be really low. And by reducing your business’ tax bill, you can save money and improve your financial security, allowing you to either invest more in capital expenses, software, equipment, or marketing to help grow your business.

And you should look at ensuring you get all the money that you’re owed because influencers work very hard. There are lots of potential tax-deductible expenses that need to be done from working with sponsors, planning, creating content, and marketing your brand.

And paying more on your income tax bill is just wasting money.

Many influencers also have several different revenue streams and this can be confusing on what elements you can pay tax on and what you can claim tax write-offs for.

Influencer Tax Deductions

So what are the main items that are tax deductible? Here's the list of the most common items that can come off your taxable income.

Equipment

The first thing that you need to consider is the equipment that you have bought to record/edit/upload content with. This equipment can often be very expensive because you need the power to process the data that you’ve recorded.

And the computer equipment isn’t just the laptop or desktop that you’re using. It does include the memory devices that you might buy, printers, and other equipment for your computer to ensure that you can complete the work.

However, there are some issues. For instance, you might not be able to claim on computer equipment if you generally use the equipment for leisure. Say for instance you’re an Instagram influencer and you use your phone for most of your work and only take emails a couple of hours a day on the laptop and then use it to play games the rest of the time.

You can fully write off cameras, streaming decks, and microphones, as long as you use them fully for work. Therefore, you have to consider how you use the equipment.

Home Office Deduction

Another item, and one that is often forgotten, is that you can claim the tax off for the purchase of office furniture and furnishings. However, you have to make sure that you’re using the office furniture for business use and that it is essential for business use.

So while a desk and desk chair could be considered items you can claim back on, other items like inspiring posters for the wall cannot as these are merely decorations, and not essential.

And you might need to consider your usage again. If you don’t use the desk that often for business purposes, then you might need to leave them off any tax returns that you have.

Office supplies can also be claimed as home office necessities.

Computer Software

Computer software can be very expensive, but that is a slight advantage as you can claim them as a reasonable business expense that you can reduce your annual tax bill on. There are numerous pieces of computer software that you can claim.

One of the most obvious is going to be image/video editing software. This can be a high monthly expense. Or you can claim against automation software like accounting, marketing, and other software. Be sure that you keep copies of all your digital receipts for this, as these might be referenced later when you have a tax audit.

You might also have some problems that not all computer software is paid upfront. Sometimes it is paid monthly or annually and you need to make sure that the payments that are going out correspond to the tax year which you’re completing. And you need to ensure that the correct amount is entered.

One of the biggest mistakes made is that influencers will sometimes multiply the current rate they pay for the software subscription by 12 months for the tax return. However, the rate of the software subscription increased during the 12 months. If this has happened, you are technically overclaiming on the tax and this is illegal.

So keep accurate records on accounting software or a spreadsheet. You can also use tax software. Tax software can help you to complete tax forms, and calculate the tax burden you have considering all the costs that can be classed as deductible expenses. Tax software is also tax deductible.

Marketing Materials

Being an influencer you are probably going to have some digital or physical marketing materials. Every time you try to publish some content on social media and then boost the content with their pay-per-click service, you can claim that advertising campaign against your tax to reduce the tax burden.

It is important to keep accurate records of your marketing expenditure. Sometimes campaigns on social media have been set at a specific outgoing, like $10 but due to the way that they charge for social media impressions and clicks, you will get charged something close. While a couple of cents will not normally make a massive difference, if you’re having many social media campaigns like that, the difference can add up. Accuracy is extremely important when it comes to taxes.

Other marketing materials can also be claimed. Say you intend a conference or expo, and you are publishing leaflets or merchandise to give out to fans, you can claim these as an expense to save on your tax return. You don’t need to charge your customers anything, you just need to note what it costs for the merchandise.

If you're a YouTube content creator, you can count marketing costs when you are promoting a video.

Delivery Costs

Speaking of merchandise, if you bring in lots of merchandise for your fans, then you can claim the costs to bring that merchandise to you. You can also take the costs of getting the goods to your customers when you ship them. However, it is also best to get the customer to pay for at least some of the shipping if not all of it.

Website Business Expenses

Influencers need a website. It is a marketing portal that allows you to collate all your content, list prices for sponsored content, and even sell merchandise. There are several website costs that you can claim back on your taxes.

The domain name, which is usually about $10 and up per year, can be claimed against the tax. In addition, you can claim the tax back for any hosting fees. Hosting can cost $15 or more per month for a simple hosting solution.

You might also want to consider the cost of building your website. If you build the website yourself, you cannot claim this back. However, if you paid a website developer to build the website, their service charge can be claimed against your tax liability.

If there are additions to your website or you’ve requested changes that have resulted in an additional charge, these can also be claimed against your annual tax bill.

Training Business Expenses

Many influencers don’t expect to have any training, but training can be a good way to sharpen skills and improve the content you’re producing. Numerous courses are highly recommended for influencers. For example, you could take photography classes, videography classes, marketing courses, and even professional qualifications to ensure your business skills are improved.

You can claim the expenses for taking these courses against your tax, reducing the burden. And it isn’t just the cost of the course that you can claim back. You can also include expenses such as the travel to the course, lodgings if you needed to stay somewhere, and the cost to eat if you could not access your home.

Travel Expenses

If you are traveling to create content, then the travel expenses can be considered tax deductible. There are many different ways that this could be shown on a tax return. For example, you could have airfare, train passage, mileage, and car renting. You might also need to claim back lodgings, food, and other expenses that are required for traveling.

But there are some restrictions. If a content shoot takes two days, but you take advantage and visit the location for personal reasons for a further five days, then only two days can be claimed for business purposes. However, some influencers get around this by spreading the content creation over the entire trip and doing less work per day, and more leisure time per day.

You might also want to include any travel insurance that you require for the trip.

Insurance Premiums

While some people don’t expect influencers to need insurance, this can be a costly mistake. Consider that you’re out shooting with a tripod and then a member of the public trips over some of your equipment and hurts themselves. They could claim compensation against you.

Another problem might be when you cover another brand and they think it is rather unflattering and could damage their business reputation. There are cases when the brand takes the influencer to court.

Therefore, you should have professional indemnity and personal liability insurance as a minimum. You should also consider that your equipment could be stolen by a member of the public. Therefore, you need to ensure equipment can be replaced should it be stolen or damaged while shooting content.

Props

Many influencers will use props in their work. For example, some give money to random people in the street or give gifts to followers when they film them on set.

Some others use props in elaborate pranks. These props are essential for the work and therefore can be deducted from the taxable income statements for tax purposes.

Though if you buy several props and use some of them for personal use, that proportion cannot be tax deductible.

Home Costs

One of the more surprising tax deductibles you can have is the proportion of the home that you work in. Most influencers work from a home office. What you need to do is to work out what proportion of the home that is, based on the square footage of the room in the proportion of the whole house. You can then take this percentage of the mortgage interest as the tax-deductible amount.

So, for instance, if you have an office that is 50 square feet in a home that is 2000 and a mortgage interest of $100 a month, then you can claim $2.5 a month from your mortgage interest.

Though this has to be used with caution. If you do work within a lounge area and this is also used for personal leisure by other members of the household, it might not be allowed as a tax-deductible expense. You might need to seek tax advice about what the best options are.

To ensure that you get the tax write-offs right, be sure to keep the calculations for the home office deduction amounts. You might need to show these to an auditor.

Common Mistakes When Claiming Influencer Tax Write-Offs

Many mistakes are often made by influencers when it comes to reducing tax burdens. Here are some of the common mistakes that are made and how you can stop the process.

Business Purpose vs Personal Use

There are going to be some costs that are challenging to distinguish between personal and business costs. For instance, when buying furniture that is in the office, is that office being used for business purposes, or is the office rarely used?

A common one is business trips, where you travel to a location and spend longer in the area than is necessary. Some of those costs might need to be personal, whereas others are going to be business related.

Taxable income can be determined based on a simple question: are you using the business expense for personal use or business? If it is for business, then you should pay taxes on the expense.

Not Keeping Records

It can be hard to keep records. Yet throughout the year, you need to keep a record of what you’re spending and what proportion you’re charging to the business. This prevents a rush toward the tax submission deadline to get all the information accurate.

There are several ways that this can be done. You can use accounting software or you can use a spreadsheet. It depends on what you’re comfortable with.

And should look at keeping receipts of all relevant costs. You might need to print these off, or you can keep a digital record of all costs, which can be better. If you do keep a digital record, ensure that there is a digital backup of the costs. You can get online cloud storage that can provide you with access wherever you are.

Do not rely on your business bank account for keeping records. They can be complicated and they won't be detailed records of what you spent the money on. Instead, keep receipts of every business expense.

Claiming the Wrong Amount

When claiming the amount for tax deductions, some people accidentally claim the wrong amount. This mistake usually comes about in one of two ways, by using the current costs for the item when historical prices were wrong or by doing a proportion calculation wrong.

While there are some allowances with wrong calculations, small amounts over several items can increase the amount that is miscalculated. And this can work both for and against you. If it is in your favor and the Internal Revenue Service does an audit, you might be fined for the discrepancy.

Then not only will you have to pay taxes on what you owed, but you might need to pay taxes and a fine.

How Indy Can Help You with Your Taxes

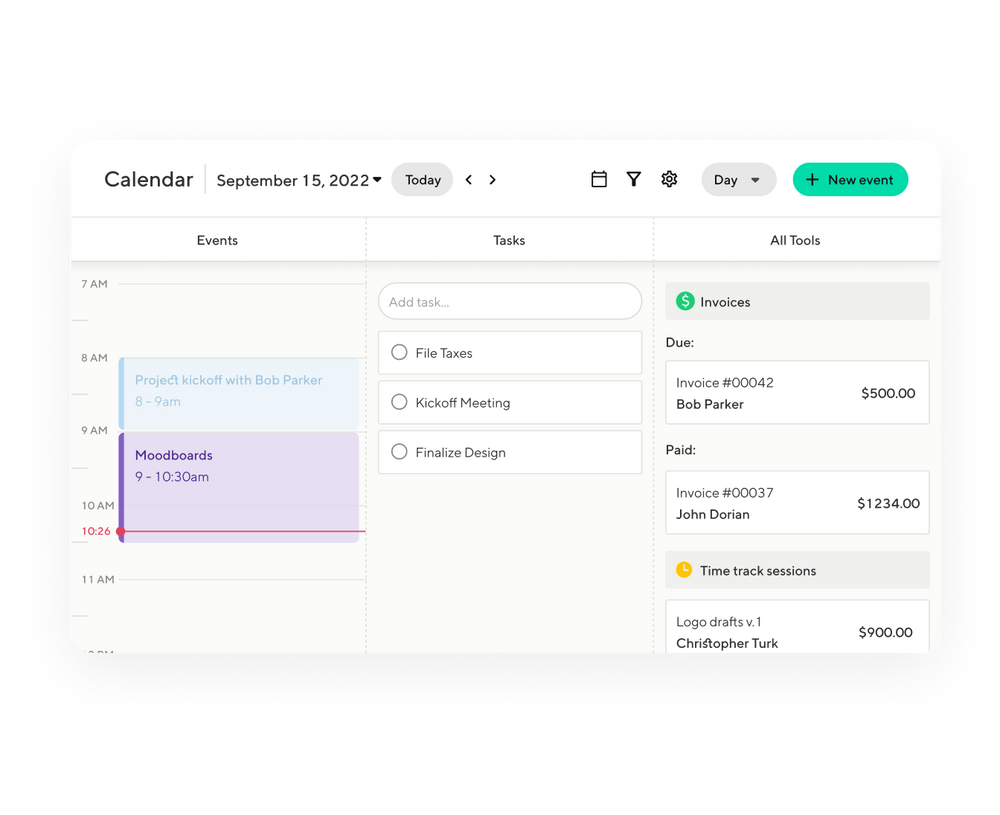

Indy is one of the leading platforms helping freelancers to manage their tax responsibilities and their time. Using Indy allows you to focus more on creating the content that allows you to earn more and spend time doing what you’re most passionate about. There are several features of Indy that you can benefit from:

Tasks: Organize your personal tax-related tasks so that they are managed easily. See all the upcoming deadlines, have reminders, develop a task list and keep track of it all.

Invoices: Need to invoice a brand you’ve worked with? No problem, Indy includes a quick and simple invoicing system that speeds up the payment process as well.

Comprehensive Platform: Indy is an all-inclusive hub, catering for your influencer journey, from the proposal, through contract creation, to invoicing, helping you to make more from your time.

Final Word: Influencer Tax Deductions

As an influencer, you are a business owner. And that means you’re able to claim some expenses against your taxable income and therefore you can earn more money from your activities. Above is the list of potential influencer tax write-offs that you can claim on your tax returns, reduce your taxable income and how much income tax you need to pay and allow you to earn more from your hard work.

If you need help when it comes to filing taxes, you might want to get tax advice from a tax professional who can specialize in self-employment tax. A tax professional can help you determine what tax-deductible expenses you have, filing taxes and also how to pay taxes efficiently.