Quarterly tax payments, a vital aspect of financial planning, are due on specific dates throughout the year: April 15, June 15, September 15, and January 15 of the following year. And while taxes might not be as thrilling as weaving narratives, they're an inevitable part of the freelance writing journey.

In this article, we'll break down the fundamentals of freelance taxes, guide you through the intricacies of tax deductions, offer strategies to navigate quarterly tax payments, and equip you with insights on future-proofing your business.

Understanding the Basics of Freelance Taxes

Freelance taxes, also known as the self-employment tax, is an additional tax that self-employed individuals are required to pay on top of federal and state income taxes.

For the 2023 tax year, you'll pay 15.3% of your net freelance income in self-employment taxes. That comes out to 12.4% for Social Security taxes and 2.9% on Medicare taxes.

Defining your freelance income

Freelance income isn't just about the checks you receive. It encompasses various forms of compensation, including project fees, royalties, and advances.

While your primary income may come from writing assignments, don't forget about other sources, such as royalties, speaking engagements, or even affiliate marketing. Keep a detailed record of each income stream, categorizing them for clarity during tax time. Consider using accounting software or dedicated spreadsheets to maintain a clear record.

Tax classification for freelancers

Choosing the right tax classification can significantly impact your financial responsibilities. For many freelancers, the sole proprietorship and LLC structures are often the most practical:

- Sole Proprietorship: Perfect for freelancers starting out; straightforward and easy to manage. As a sole proprietor, you and your business are considered one entity for tax purposes. While it's easy to set up, keep in mind that you're personally responsible for all business debts.

- Limited Liability Company (LLC): Separates personal and business assets, shielding your stuff from business-related liabilities. The LLC structure combines the simplicity of a sole proprietorship with limited liability, meaning your personal assets are generally protected from business debts. Income and losses pass through to your personal tax return.

However, here are other business entities you can file under:

- S Corporation: Enjoy liability protection and potential tax advantages. An S Corporation provides liability protection like an LLC but with a different tax structure. Business profits and losses pass through to shareholders, who report them on their individual tax returns. Shareholders can receive both a salary and share in profits, potentially reducing self-employment taxes.

- C Corporation: A C Corporation is a separate legal entity with shareholders, directors, and officers. It offers the most significant liability protection but involves more administrative complexity. Profits are taxed at the corporate level before distributions to shareholders, leading to potential double taxation.

- Partnership: Ideal if you're teaming up with others in your freelancing venture. It's similar to a sole proprietorship but with multiple owners, called partners. Each partner reports their share of business income and losses on their individual tax return.

- Professional Corporation (PC) or Professional Limited Liability Company (PLLC): Tailored for licensed professionals like writers, doctors, or lawyers. It provides liability protection for professional acts while allowing professionals to enjoy the benefits of a corporate structure.

Chatting with a tax professional is a smart move to figure out what works best for your unique situation.

Keeping immaculate records

Organization is your best friend when it comes to tax season. Create a filing system for both digital and physical receipts, categorize expenses accurately, and maintain a separate business bank account. Using accounting software can streamline this process, allowing you to focus more on your writing and less on paperwork.

Navigating Deductions and Credits

Knowing the ins and outs of tax write-offs and credits is a big deal for freelancers, as it can seriously affect how much you owe in taxes and your overall financial health.

Identifying tax-deductible expenses

The world of tax-deductible expenses is vast, and as a freelance writer, you have unique opportunities. Consider deducting costs associated with your home office, professional memberships, writing conferences, and even a portion of your internet and phone bills. Keep meticulous records, and don't hesitate to consult with a tax professional to ensure you're not missing out on any eligible deductions.

Home office deductions

If you have a designated workspace at home, you may qualify for a home office deduction. Ensure your workspace meets the criteria set by the IRS, which generally includes regular and exclusive use for business purposes. Measure the square footage of your office space compared to your entire home to determine the percentage of applicable expenses, such as rent or mortgage interest, property taxes, and utilities.

Here's a list of tax deductions you can claim this quarter:

- Rent or mortgage interest

- Property taxes

- Utilities

- Internet and phone bills

- Home maintenance costs

- Office furniture and equipment

- Home depreciation

- Home or renter's insurance

- Security system for your home office

- Cleaning services for your home office space

- Professional services (such as legal or accounting services)

- Home office supplies

- Repairs (excluding major renovations)

- Software and technology

- Business-related books and publications

Remember, to qualify for any income tax deduction, your home office must meet the IRS criteria, which includes regular and exclusive use for business purposes.

This means that, in some cases, including home maintenance costs, internet and phone bills, utilities, rent and mortgage interest, home or renter's insurance, etc., you'll need to determine the portion that you'll be able to write off based on the square footage of your home office space.

Additionally, it's crucial to maintain accurate records and receipts for every business expense claimed.

Freelance writer-specific deductions

Freelance writers often incur unique expenses related to their craft. Deduct expenses for research materials, subscriptions to writing-related publications, and the costs associated with maintaining an online presence, such as website hosting fees. Keep detailed records and receipts to substantiate these deductions in case of an audit.

Quarterly Taxes and Payment Strategies

Freelancers must grasp the importance of quarterly taxes and payment strategies to manage cash flow effectively, avoid penalties, and stay ahead of their tax obligations.

Grasping quarterly tax obligations

As a freelancer, you're likely familiar with the feast-and-famine cycle of income. To avoid a hefty tax bill at the end of the year, make quarterly estimated tax payments. Calculate your expected annual income, deductions, and credits, then divide that amount by four to determine your quarterly payments. Staying ahead of these payments helps you manage your cash flow and avoids potential penalties.

Here's 5 more tips to help you stay on top of tax season:

- Use Tax Software for Accuracy: Invest in reliable tax software to accurately calculate your quarterly tax obligations. This ensures you consider all relevant factors, including deductions and credits, reducing the risk of underpayment.

- Set Up a Separate Savings Account: Create a dedicated savings account for your quarterly tax payments. Transfer a percentage of each payment you receive into this account, ensuring you have the funds available when tax time arrives.

- Consider Adjustments Throughout the Year: Your income may fluctuate throughout the year. Regularly reassess your quarterly payments and adjust them as needed to align with changes in your income, deductions, and credits.

- Explore Tax Withholding on Additional Income: If you have additional sources of income outside your freelance work, such as part-time employment, explore adjusting your tax withholding to cover some of your tax liability. This can help distribute the burden more evenly.

- Factor in Self-Employment Tax: Don't forget to account for self-employment tax when calculating your quarterly payments. This includes Social Security and Medicare taxes that are typically covered by employers for traditional employees.

Strategies for tax planning

Beyond quarterly payments, effective tax planning involves projecting your income, optimizing deductions, and considering potential changes in tax laws. Leverage tax planning tools and consult with a tax professional to develop a personalized strategy.

Explore retirement savings options, such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k), to secure your financial future while minimizing your taxable income.

- Regularly Review and Adjust Projections: Tax planning is an ongoing process. Regularly review and adjust your income projections, taking into account any changes in your business, such as new clients, increased rates, or additional income streams.

- Explore Business Expenses: Look for opportunities to increase business expenses that are legitimately deductible. This might include investing in professional development, upgrading equipment, or attending industry conferences. Be proactive in seeking out potential deductions.

- Maximize Retirement Contributions: Take full advantage of retirement savings options. Contribute the maximum amount allowed to tax-advantaged accounts like a SEP IRA or Solo 401(k). This not only secures your financial future but also reduces your taxable income.

- Consider Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): Explore health-related tax savings options. Contributions to HSAs or FSAs are often tax-deductible and can provide additional ways to minimize taxable income.

Compliance and Legal Considerations

As a freelance writer, you need to stay informed about tax laws that affect your specific industry, meet business regulations, and tick all the legal boxes to protect your professional reputation.

Staying compliant with tax laws

The tax landscape is dynamic, and changes may impact your deductions and obligations. Regularly check for updates from reliable sources, attend webinars or workshops, and consider joining professional organizations that provide insights into tax regulations for writers.

Hiring a tax professional

An accountant or tax advisor with experience in working with freelancers can offer valuable advice, help you maximize deductions, and ensure compliance with tax laws. The cost of hiring a professional is often outweighed by the potential savings and peace of mind.

- Seek a Specialist in Freelancer Taxes: Freelancers often have unique tax situations, with income variability, diverse deductions, and specific industry nuances. Look for a tax professional with a specialization in working with freelancers or self-employed individuals.

- Establish Clear Communication: Effective communication is key to a successful partnership with your tax professional. Clearly articulate your freelance business structure, income sources, and any significant changes in your financial situation. Regularly update your tax professional on any business developments, ensuring they can offer timely advice and adapt your tax strategy as needed.

Future-Proofing Your Freelance Finances

Planning for the future is essential for freelance writers, and understanding financial strategies like retirement planning and adapting to changes in tax regulations is key to securing a stable and prosperous financial future.

Retirement planning for freelancers

Freelancers often face uncertainty in income, but that doesn't mean neglecting retirement planning. Explore retirement savings options tailored for the self-employed, such as a SEP IRA or a Solo 401(k).

Contribute consistently to secure your financial future, taking advantage of potential tax benefits while creating a safety net for your golden years.

- SEP IRA: Particularly well-suited for freelancers without employees or those with a small number of employees. It's quick and straightforward to establish, making it an accessible option for freelancers. Contributions are tax-deductible, and you can contribute up to 25% of your net earnings from self-employment, with a maximum annual contribution limit.

- Solo 401(k): Well-suited for freelancers who operate as sole proprietors without employees. Allows for higher annual contributions compared to a SEP IRA, with both employer and employee contributions.

General tips for both retirement plans:

- Consistent Contributions: Make regular contributions to your chosen retirement plan, even during periods of income variability.

- Consult with a Financial Advisor: Seek advice from a financial advisor to determine the best retirement plan based on your specific financial situation and goals.

- Maximize Tax Benefits: Understand the tax implications of your contributions and withdrawals, optimizing your strategy for maximum tax benefits.

Adapting to changes in tax regulations

The only constant in life is change, and tax regulations are no exception. Stay proactive by regularly checking for updates in tax laws, especially those relevant to freelancers. Adjust your financial practices accordingly, whether it involves modifying deductions, adopting new technologies for record-keeping, or reassessing your overall tax strategy.

How Can Indy Help?

Juggling your writing business and making sure that you consistently pay taxes is tricky. It's especially challenging when you have to keep tabs on things like invoices, clients, projects, and net income.

That's where Indy comes in! Here's how Indy fast-tracks your success:

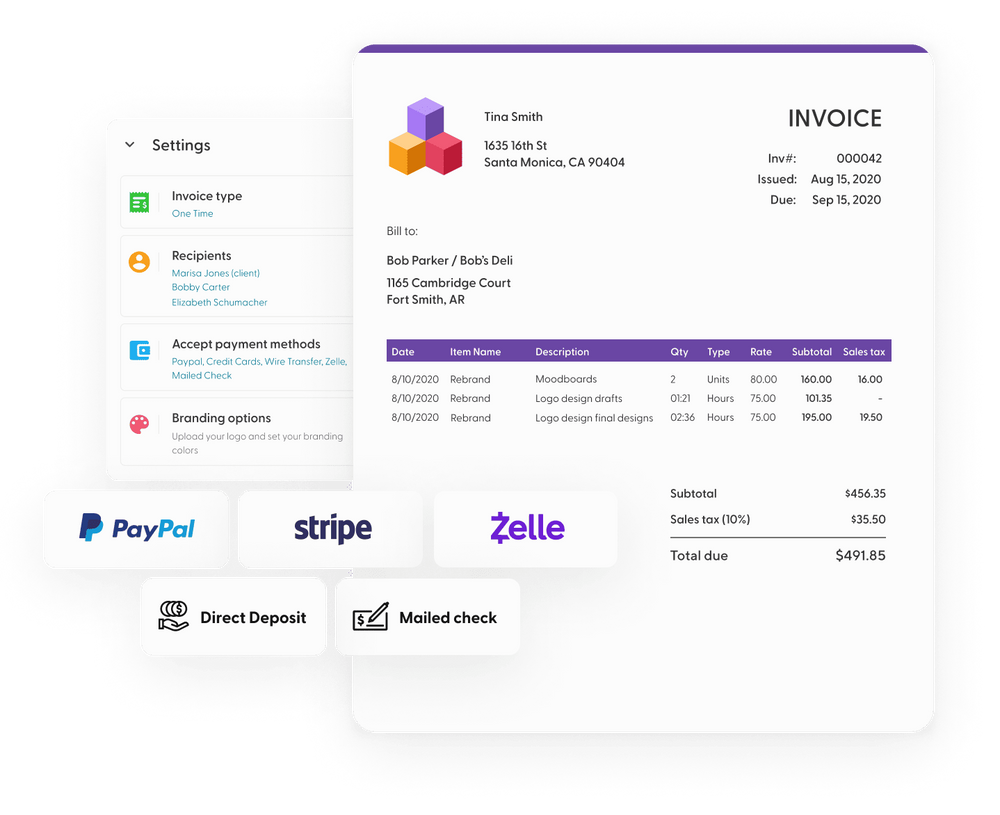

- Invoices: Generate polished invoices with ease and get paid right through Indy. Keep a clear record of your invoices, including those that have been paid and those still pending.

- Tasks: Use to-do lists and Kanban boards to track writing projects and set up reminders for each tax season to stay organized and on top of your financial obligations.

- Files: Upload, store, and share writing projects (and any other documents) with clients and get feedback and approval.

Plus, get all the tools you need to grow your writing business faster, including legally vetted contracts, client portals, business proposals, and form templates (questionnaires, intake forms, project briefs, and feedback forms). Get started today for free!

A Quick Recap

And there you have it! A comprehensive guide to navigating the intricate world of taxes for freelance writers. It's crucial for freelancers to pay self-employment tax on their income, ensuring compliance with tax regulations and contributing to their Social Security and Medicare obligations.

From understanding the basics of freelance income to future-proofing your finances, these insights and strategies will empower you on your journey as a self-employed wordsmith.

Want to make it easier to track your self-employment income? Get started with Indy for free and manage your entire business in one place, from contracts to invoicing and everything in between.