Creating invoices is probably the least favorite part of your work. However, 29% of freelance invoices are paid late, with discrepancies in invoices being one of the key reasons.

A pro forma invoice and standard invoice are the most common invoice types freelancers send. Differentiating between the two invoices and knowing when to send each can be confusing for some freelancers.

Let us make your life easier. Here is all you need to know about pro forma invoices and invoices.

What Is a Pro Forma Invoice?

A pro forma invoice is a sales document created by the freelancer for the client. It includes the details of the new order, including the services to be offered and their prices. A pro forma invoice is issued before the freelancer delivers the services to the consumer.

Uses of a Pro Forma Invoice

A pro forma invoice is like a quote you send to a client to give them a general estimate of the services you offer and the rates you charge for them. It can also be useful in highlighting potential variables that may affect the amount on the final invoice.

You should send a pro forma invoice when a potential client expresses interest in your services and asks for information on pricing, terms, etc. A pro forma invoice is valid for a particular period, usually until the client signs the contract. However, a pro forma invoice can act as an official record and be used to resolve any discrepancies in the final invoice.

What Information Should a Pro Forma Invoice Include?

A pro forma invoice should include the following information contents:

- Name and information of the freelancer and prospective client

- Date of issue

- Unique invoice number

- Validity of the proforma invoice

- Description of services, the cost of each service, and total estimated cost

- Sales terms and payment terms

- Freelancer's signature

What is an Invoice?

An invoice is a document that lists the services provided to a client, along with their respective prices and the total due amount. You issue an invoice after delivering the required services to the client. Invoices look similar to pro forma invoices and have the same format, but they differ in purpose.

Uses of an Invoice

The primary purpose of an invoice is to request payment from clients. You can also use an invoice to keep track of your sales, track your best-selling products/services, forecast future sales, and record revenue for tax purposes.

What Should Information Be on an Invoice?

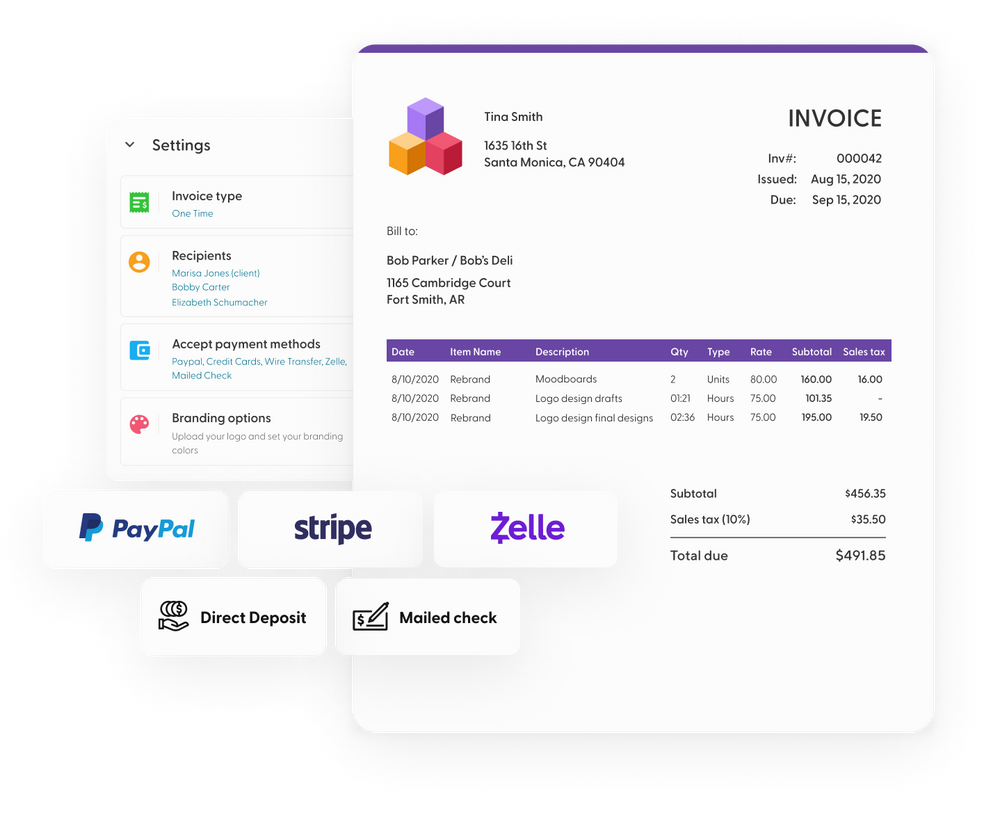

An invoice should include the following details:

- Invoice number

- Client's name and details

- Your name and details

- Job or project title

- Important dates: date of starting and completing the project, date of issuing the invoice, and the final due date

- Details about the job, such as total services offered and work hours (if relevant)

- The amount associated with each service and the total amount the client needs to pay

- Payment terms

- Bank details and/or other payment information

Key Differences between a Pro Forma and Invoice

A pro forma invoice and invoice look similar, and it can be confusing for new freelancers to figure out when to send which invoice. Here are the key differences between a pro forma invoice and an invoice.

Time and Purpose of Issue

A pro forma is like a quote sent to a potential client on request. A prospective client will inquire about your services first, and if they are comfortable with the pricing and terms, they'll give you the job. You need to issue a proforma in response to the inquiry sent by the client. After receiving the pro forma invoice, the client can accept the terms and assign the job to you or attempt to negotiate.

On the other hand, you need to send an invoice after you have completed the work assigned to you. You always send the invoice to ask for payment for the services offered.

Information Included

In most cases, the information displayed on a pro forma and an invoice are similar; however, it is prone to change. A pro forma includes the estimated costs of the services the client seeks.

The information on the invoice is final, and it can be different from the pro forma invoice. Suppose the client changes their requirements after receiving the pro forma invoice or negotiates the terms or price. In such cases, the details on the invoice will differ from the pro forma invoice.

Uses

A pro forma invoice is usually issued in response to a potential client's inquiry about your services, price, and terms.

An invoice is an official document used for collecting payment from the client after delivering the promised services

In a nutshell, you send a pro forma invoice before delivering the services and an invoice after completing the work. The purpose of a proforma invoice is to inform a client about your costs and payment terms while you send an invoice to request the client to pay for the services rendered. A pro forma invoice isn't mandatory, and two parties can deal in good faith without it. However, a final invoice is crucial for getting paid promptly.

Frequently Asked Questions

What is the purpose of a pro forma invoice?

The purpose of a pro forma invoice is to provide a potential client with information regarding your services and prices. A client might request a pro forma invoice if they want to know about the services you offer, the rates you charge, and your payment terms.

Can payment be made on a pro forma invoice?

No, payments cannot be made on a pro forma invoice. A pro forma invoice is not a legal document, and a client has no obligation to pay the amount on a pro forma invoice. If you want to ask for a payment, you'll need to issue a final invoice.

When should an invoice be issued?

The timeline of sending an invoice can vary from freelancer to freelancer. Some freelancers prefer sending the invoice immediately after the client approves the work, whereas others send invoices after a selected period of 7, 15, or 30 days. You can choose a system that works for you.

Are receipts and invoices the same?

No, an invoice is a request for payment, whereas a receipt is proof of payment. A freelancer sends an invoice to a client to ask for payment after rendering the services. Once the client pays the invoice, they send a receipt to the freelancer as proof of payment.