The modern workforce has witnessed a significant shift towards freelancing and self-employment. And while being a freelancer or self-employed person can be very rewarding, one of the biggest challenges is staying organized with your finances, which means having the right accounting software in place to keep track of income and expenses. With so many options out there, it can be hard to decide which one is best for you.

That’s why we’ve put together this guide on the best freelance accounting software and accounting apps. This article explores the best accounting software programs and tools tailored to meet the unique needs of this growing segment of the workforce.

Key Considerations for Accounting Software for Freelancers

Freelancers and self-employed professionals face distinct financial challenges compared to traditional employees. They must handle invoicing, track expenses, prepare taxes, and manage project finances independently. When searching for the easiest accounting software tool, it's essential to consider features that address these specific requirements. Do you need a basic tool and easy-to-use software? Maybe just the best free accounting software to scan receipts and provide receipt capture would be sufficient?

Key features to look for include invoicing capabilities, business expenses tracking, sales tax tracking and preparation features, integration with payment gateways and bank payments, and time tracking.

Why Freelance Accounting Software Is So Important?

Accounting software tools are essential for freelancers and self-employed individuals for several compelling reasons:

Financial organization

Freelancers and self-employed professionals often have multiple billable clients and projects, leading to a high volume of financial transactions. Accounting software helps organize income and expenses, ensuring that financial records are accurate and up-to-date.

Time-saving

Manual bookkeeping and wave accounting can be time-consuming and prone to errors. The best bookkeeping software automates various financial tasks, such as double-entry accounting, invoicing, expense and automatic mileage tracking, and sales tax calculations, saving freelancers valuable time that they can invest in their core business activities.

Invoicing efficiency

Freelancers need to send professional invoices to clients promptly. Accounting software streamlines the invoicing process, allowing users to create and send and recurring invoices quickly, track payment status, and send automatic late payment reminders for overdue invoices.

Expense tracking

Expense tracking is crucial for tax deductions and financial decision-making. Accounting software simplifies expense and inventory tracking by categorizing transactions, enabling users to identify tax-deductible items easily.

Tax compliance

Freelancers and self-employed individuals are responsible for their file taxes, sales taxes, tax reporting, inventory management, and payments. Accounting software for freelancers assists in generating accurate tax reports, making it less stressful and reducing the risk of errors.

Financial insights

Real-time financial data is essential for making informed business decisions. Accounting software provides comprehensive financial reports, such as profit and loss statements and analysis, enabling freelancers to mileage tracking of their business growth that assess their business's financial health and identify areas for improvement.

Payment management

Freelancers often deal with various payment methods, such as credit card payments, cards, bank transfers, and online payment platforms. Accounting software integrates with these payment gateways, or a bank account, allowing seamless payment tracking, receipt scanning, receipt capture, automatic payment reminders, and reconciliation.

Collaboration and communication

Some freelancer accounting software allows small business owners a collaboration with accountants or separate business team members. This feature is valuable for freelancers who work with others or seek professional advice on financial matters.

Scalability

As freelancers and self-employed professionals track the mileage of their businesses' growth, their financial needs become more complex. Freelancer accounting software can scale with their business, accommodating additional clients, projects, and financial transactions.

Legal and financial compliance

Proper financial record-keeping is vital for complying with legal and financial requirements. Accounting software helps freelancers maintain organized records, reducing the risk of penalties and audits.

Data security

Reputable accounting software providers prioritize data security, ensuring that sensitive financial information is protected from unauthorized access or data breaches.

Accounting software is a crucial tool for freelancers and self-employed individuals to maintain financial organization, save time, comply with tax regulations, make informed decisions, track the mileage of their business, and streamline various financial tasks.

By leveraging accounting software's capabilities, freelancers can focus on their work while efficiently managing their financial affairs, leading to greater financial stability and success in their self-employment journey.

Key Features to Look For in a Good Accounting Software

Do you really need all advanced accounting features or a professional accounting app containing bookkeeping software ready for wave accounting? What would be the best accounting software for you? When searching for the best accounting software, consider these key features to ensure it meets your business needs.

Invoicing and billing

The software should allow you to create professional invoices, customize templates, add your logo, and track payment status. Recurring invoices and setting automatic late payment reminders are valuable time-saving features.

Expense tracking

Efficient expense tracking in the best accounting software for freelancers helps categorize and record business and personal expenses accurately, making it easier to claim deductions during tax time.

Bank reconciliation

The ability to integrate with your bank accounts and automatically reconcile transactions ensures accurate financial records.

Financial reporting

Comprehensive financial reports like profit and loss statements, balance sheets, wave accounting, and cash flow analysis provide valuable insights into your business's financial health.

Tax preparation and compliance

Look for software that assists in generating tax reports and supports tax compliance, including calculating sales tax and managing tax liabilities.

Integration with payment gateways

The software should seamlessly integrate with popular payment gateways, enabling smooth payment processing and reconciliation.

Time tracking and project management

For freelancers and professionals, billable hours, sales tax tracking or managing projects, time tracking, and integration with project management tools are crucial features.

Mobile accessibility

Having a mobile app or mobile-friendly interface allows you to manage finances and time tracking on the go.

Multi-user access and collaboration

If you work with an accountant or team members, the software should allow multi-user access and collaboration features.

Data security

Ensure the software employs robust data security measures to protect sensitive financial information.

Scalability

As your business grows, the software should be able to handle increased transaction volumes and additional features.

Customer support

Look for a software provider that offers reliable customer support, preferably through various channels like email, phone, or live chat.

Integration with other software

Check if the accounting software can integrate with other essential business tools you use, such as CRM software or e-commerce platforms.

Automation and workflow

The software's automation capabilities should streamline repetitive tasks, reducing manual data entry and saving time.

User-friendly interface

A user-friendly interface makes it easier to navigate and use the software effectively, even for those without extensive accounting knowledge.

Cloud-based accessibility

Cloud-based accounting software allows you to access your financial data from any device with an internet connection, ensuring flexibility and data backup.

Cost and pricing plans

Consider the software's pricing plans and the value it provides for your business needs. Look for transparent pricing with no hidden fees.

By evaluating accounting software for freelancers based on these key features, you can find the best solution to meet your specific requirements and effectively manage your finances, whether you're a freelancer, a self-employed professional, or a small business owner.

6 Best Accounting Software and Useful Tools for Freelance Businesses

Accounting software for freelancers has become increasingly popular among self-employed professionals as a way to manage their financial affairs. There are many different types of accounting software available in the market today, each with its own features and benefits.

1. Indy

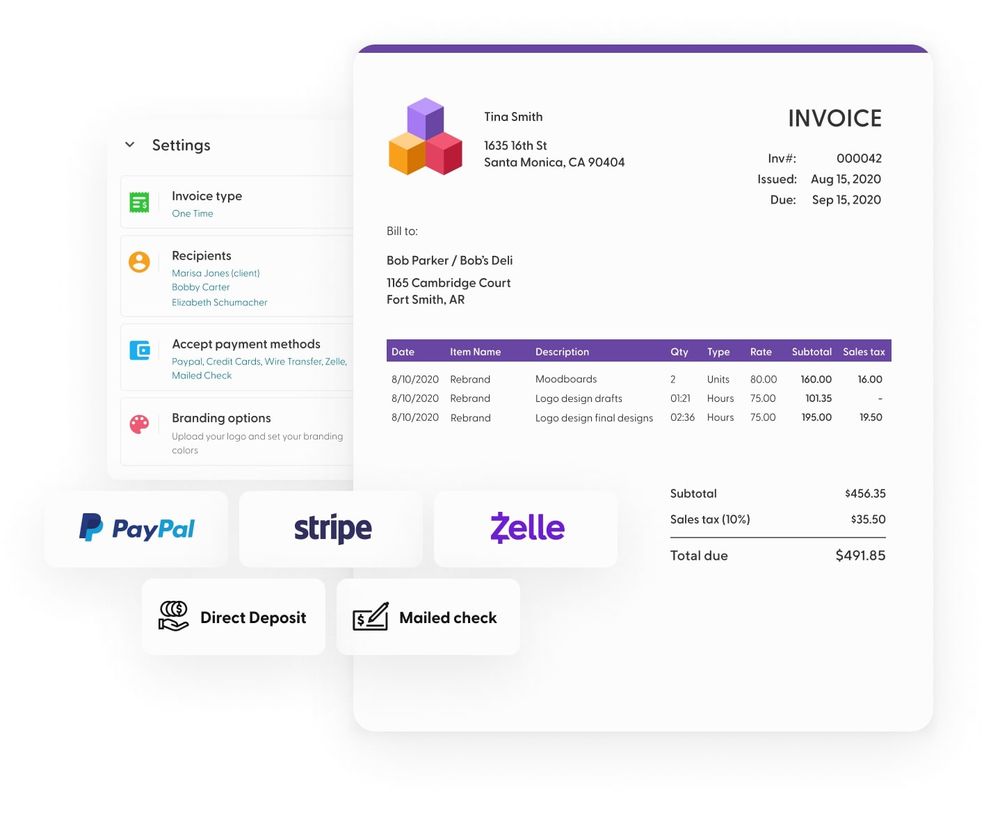

Although Indy is not a typical freelance accounting software nor accounting app it has some powerful accounting features. In addition to allowing project tracking and self-management in your small business, it can also help you in areas such as online payments, bank transactions, tracking income, and client management. It enables you to track income, track the time you spent on different projects, and manage invoices as well as manage expenses or predicting financial future.

Aside from that, Indy has everything you need to manage a freelance business, from contracts and to-do lists to real-time chats and client management.

It is a helpful tool amongst desktop and mobile apps that provides different sort of support for small business owners and freelancers, including accounting tools. All without additional money spent on legal help or tax professionals. Indy could be your favorite accounting software without actually being a freelancer accounting software!

2. QuickBooks

QuickBooks is one of the most widely used accounting software for freelancers. It offers an intuitive user interface, enabling users to easily create invoices, track time, income, and expenses, generate financial reports, accept payments online, provide double-entry accounting, mileage tracking, and more for businesses of all sizes. QuickBooks Online also integrates with major payment gateways such as PayPal and Stripe and includes mobile access capabilities for tracking finances on the go.

3. Xero

Xero is another powerful freelance accounting software that makes it easy for businesses to manage invoicing, recurring invoices, expense tracking, payrolls, bank reconciliations, taxes preparation, and filing taxes electronically. It provides extensive reporting capabilities, including balance sheets and cash flow analysis, and mileage tracking that can help to identify areas for improvement in a business's financial health. It also allows for collaboration between team members or accountants for discussing financial matters or completing accounting tasks efficiently.

4. Freshbooks

Freshbooks accounting software was designed for freelancers or self-employed professionals who need an easy way to invoice clients and keep track of their finances. It is not an advanced bookkeeping software. It enables users to generate customized invoices quickly along with automated reminders so they don’t miss any payments due from billable clients. Additionally, it offers robust expense and income tracking capabilities with automatic categorization of transactions which helps users accurately report their income during tax season or quarterly taxes.

5. Wave

Wave offers cloud-based best free accounting software geared towards small businesses or start-ups looking to maintain efficient financial records without breaking the bank. It automates tedious tasks like data entry while providing comprehensive reporting options, including profit & loss statements as well as balance sheets which can be used to make informed decisions about business growth opportunities or understand areas where costs need to be cut down further.

6. Zoho Books

Finally, Zoho Books is another good choice for small businesses that require additional features like multi-currency support or integration with e-commerce stores such as Shopify or Magento. It offers tools like project management and time tracking, which can help freelancers keep track of ongoing projects while generating accurate billing invoices based on billable hours worked instead of just flat fees per project completion. Additionally, it provides a suite of compliance tools that enable businesses to stay up-to-date with legal requirements related to their various income taxes, filings, or other documents related to their activities.

How to Choose the Best Accounting Software Based on Your Individual Needs?

Choosing the best overall accounting software based on your individual needs requires a thoughtful and systematic approach. Here are some steps to help you make an informed decision on top accounting software:

- Assess Your Requirements: Begin by identifying your specific accounting needs. Consider factors like the size of your business, the volume of transactions, invoicing frequency, tax complexities, integration requirements, and any industry-specific features you may need.

- Set a Budget: Determine how much you are willing to invest. Some software options are just free software with limited access and accounting features or offer free plans or trials, while others have tiered pricing based on features and usage.

- Research Different Software Options: Conduct thorough research to explore various software available in the market. Look for software that aligns with your business requirements and falls within your budget.

- Read Reviews and Testimonials: User reviews and testimonials provide valuable insights into the strengths and weaknesses of different software. Pay attention to feedback from users with similar business needs as yours.

- Consider Cloud-Based vs. On-Premises: Decide whether you prefer a cloud-based accounting solution for remote access and data security or an on-premises system for more control over data hosting.

- Look for Integration Capabilities: If you use other business tools like CRM, project management, or e-commerce platforms, check if the accounting solution integrates seamlessly with these tools. Integration can streamline workflows and data exchange.

- Check Data Security Measures: Ensure that the software you choose follows industry-standard data security practices to protect your financial information.

- Evaluate User-Friendliness: A user-friendly interface is essential for the efficient use of the software. Consider if the software is intuitive and easy to navigate, especially if you or your team members lack extensive accounting experience.

- Explore Support and Training: Look for software providers that offer reliable customer support and training resources. Good customer support can be invaluable if you encounter any issues or have questions.

- Take Advantage of Free Plans, Trials, and Demos: Many providers offer free plans, trials, or demos. Take advantage of these opportunities to test the software's features and functionalities to see if it meets your needs.

- Scalability: If your business is expected to grow, ensure that the software can accommodate increasing transaction volumes and additional users or features.

- Seek Recommendations: Ask for recommendations from colleagues, business associates, or industry peers who have experience with accounting.

- Analyze Contract Terms: Carefully review the terms and conditions of the software contract, including any hidden fees, cancellation policies, or data export options.

- Vendor Reputation and Experience: Consider the reputation and experience of the software vendor in the accounting software market. Established and reputable vendors are more likely to provide reliable and well-supported tools.

By following these steps, you can find accounting software that perfectly matches your individual needs, streamlining your financial management and helping your business thrive. Remember that making an informed decision upfront will save you time, money, and potential headaches in the long run.

Choosing the Best Accounting Software for Freelancers and Self Employed

Selecting the right accounting software for freelancers and self-employed individuals can be challenging, but with a thoughtful approach and careful research, you can find one that perfectly meets your needs. Assess your requirements, set a budget, read reviews, consider cloud versus on-premise solutions, and look for integration capabilities as well as data security measures to ensure the safety of financial information.

Take advantage of free plans, trials, or demos to explore features and functionalities before making an informed decision. Additionally, evaluate user-friendliness while seeking recommendations from industry peers who have experience using such software. Finally, analyze contract terms carefully in order to avoid any hidden fees or cancellation policies down the line. By following these steps, you'll be able to select the best accounting software for freelancers tailored to your individual business needs.

Freelancer Accounting Software: A Summary & What Should You Know

By carefully assessing individual business needs, setting a budget, researching different software options, and considering user-friendliness and integration capabilities, freelancers and self-employed individuals can make an informed decision in selecting the most suitable accounting software for freelancers. With the right accounting tool in place, they can streamline financial processes, save time, and focus on growing their businesses with confidence.